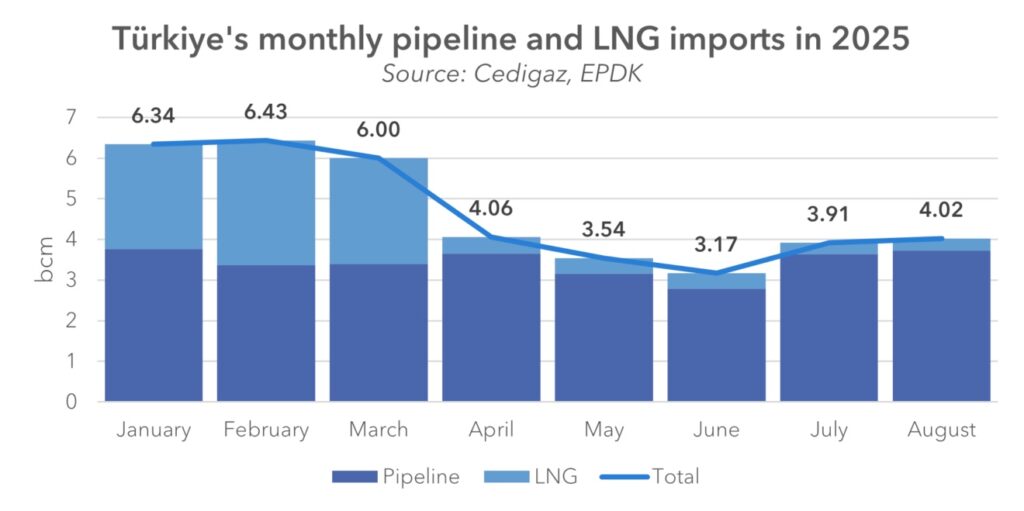

Plans for Turkey’s gas hub are gaining momentum, with the country making steady progress as it positions itself as a key LNG and pipeline enabler in the wider region. As Europe reshapes its supply landscape, the Turkey gas hub strategy is supported by expanding LNG capacity, growing transit flows, new trading mechanisms and ongoing market reforms.

Turkey’s dual strategy of pipelines and LNG provides strategic leverage in Europe’s evolving gas market, but realising its hub ambitions will require further market reform and transparency.

By Irina Mironova for CEDIGAZ.

Original article: Turkey’s balancing act between pipelines and LNG in a re-shaped European gas landscape.

Related Posts

Turkey’s LNG buying spree reshapes gas import strategy and weakens Russian leverage