The Australian government released the National Hydrogen Strategy (the Strategy) in November 2019 and has continued to outline its support for hydrogen through the First Low-Emissions Technology Statement, released in September 2020.

The government has stated its commitment to reducing Australia’s emissions through technology investment, rather than through carbon pricing, with the Technology Investment Roadmap a core element of its long-term emissions reduction strategy.

The government has taken a technology-neutral approach and the Strategy refers to ‘clean’ hydrogen, which includes both green and blue hydrogen.

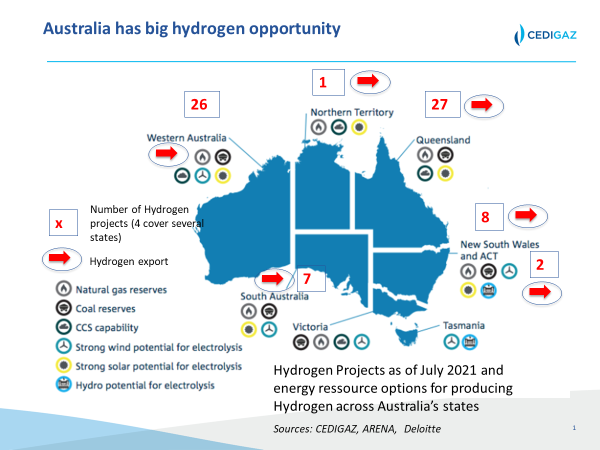

The Strategy is export oriented. Building on Australia’s unique assets and its track record in energy exports, it aims to build large-scale supply chains to make Australia a leading exporter of hydrogen energy and technologies, and one of the top three exporters to the promising Asian markets by 2030.

While primarily focused on the export market, the Strategy looks to initially build a strong domestic hydrogen sector that will underpin Australia’s export capabilities. Hydrogen demand will be concentrated in large hydrogen hubs and will focus on four applications: its use in transport, as industrial feedstock, blended in gas networks and for electricity grid support/energy storage.

One of the government’s priorities and a key success factor for Australia’s hydrogen industry is to reduce the production cost of hydrogen below AUD2/kgH2 — US$1.4 (‘H2 under $2’).

From 2018 to May 2021, at least AUD1.5 billion (US$ 1.1 billion) have been awarded or committed to progressing clean hydrogen projects. Support is also provided to CCUS technologies and the creation of CCUS hubs, with the goal of reducing the cost of CO₂ compression, hub transport, and storage for CCS below AUD20/tCO₂ (US$14).

Australia is emerging as a key player in the global hydrogen supply chain, taking the lead, together with Europe, on renewable hydrogen developments around the globe.

As of July 2021, Australia has 88 pilot, demonstration and small-to-mega/giga scale hydrogen projects (both green and blue hydrogen) at different stages of development. Among them, nearly 30 projects are under construction or in the advanced planning stages (combined electrolysis capacity of 360 MW). This includes the first three commercial-scale (10 MW) electrolyser projects that received funding from the government in May 2021.

The hydrogen production and export businesses are evolving in parallel: 39 projects envisage exports, as the sole end use or, very often, in combination with domestic use. This includes seven giga-scale plants with a combined electrolysis capacity of 63 GW at full development. This represents almost a quarter of the 280-GW capacity of the largest projects proposed in the world. These giga-scale projects are at the earliest stages of development planning, as would be anticipated given the emergent stage of the industry.

There are a limited number of blue hydrogen projects (9 projects only). However, this may change with the recent adoption of funding dedicated to CCUS and the forthcoming legislation incentivising CCS. Among these projects, the Hydrogen Energy Supply Chain (HESC) started operation at pilot scale in March 2021. With first shipments of LH2 by the end of 2021, it will be the first time that LH2 is transported between two continents.

Australia has been working on building international supply chains in promising Asian importing markets since 2018. Since June 2021, the government has stepped up its efforts and has pursued wider international and technology-led cooperation and has signed (or deepened) partnerships with key partners: Japan, South Korea, Germany, Singapore and the United Kingdom.

These partnerships, backed by business interests and financial incentives, lay the foundations for a global, clean hydrogen market, and position Australia at the forefront of developing a huge hydrogen export industry.

Source: Sylvie Cornot-Gandolphe, CEDIGAZ, Australia’s hydrogen strategy, hydrogen strategy, hydrogen