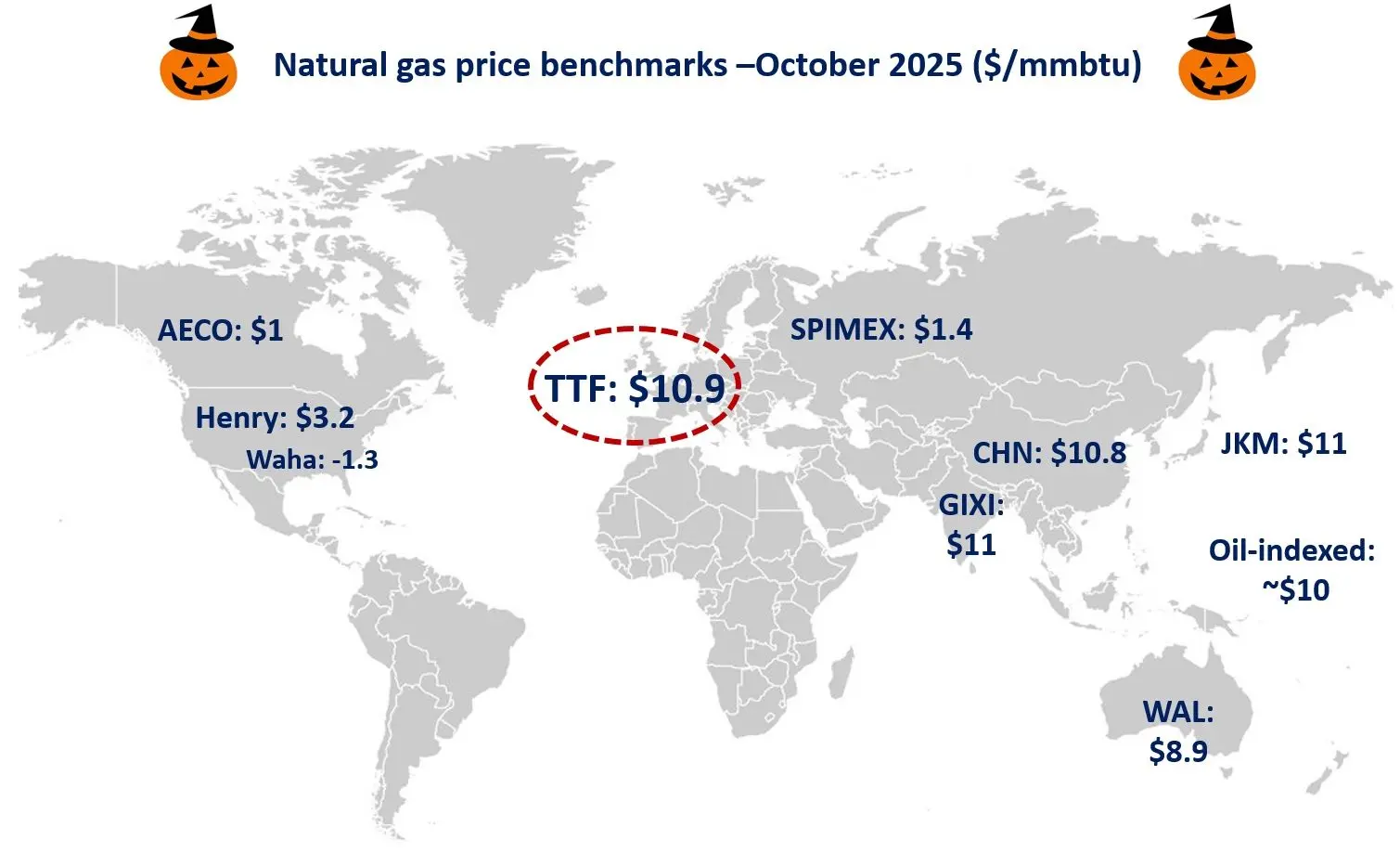

Global gas prices showed diverging trends last week, with Asian LNG holding steady on post-winter buying, European prices falling on milder weather and stronger wind output, and US Henry Hub easing after smaller-than-expected storage withdrawals.

The Northeast Asian spot LNG benchmark JKM (March delivery) remained almost unchanged in the high-USD 10s/MMBtu on 13 February from the previous weekend (6 February). Prices slipped slightly early in the week amid limited market drivers and adjustments in China ahead of the Lunar New Year holidays. Buying interest from Northeast Asian importers then picked up for post-winter inventory replenishment, pushing prices back to the high-USD 10s/MMBtu range by week’s end. METI reported that Japan’s LNG inventories for power generation stood at 1.89 million tonnes as of 8 February, down 0.19 million tonnes week-on-week.

European TTF prices (March delivery) fell to USD 11.3/MMBtu on 13 February from USD 12.3/MMBtu the previous weekend (6 February). Prices declined early in the week on forecasts of mild weather and increased wind power generation. Mid-week, TTF rebounded as continued storage withdrawals, unplanned maintenance at Norwegian gas facilities and colder temperature forecasts raised supply concerns. Toward the end of the week, prices softened again as wind output recovered and supply conditions improved. According to AGSI+, EU-wide gas storage stood at 34.4% on 6 February — down from 37.4% the previous weekend, 25.4% below last year and 31.4% below the five-year average.

US Henry Hub prices (March delivery) edged down to USD 3.2/MMBtu on 13 February from USD 3.4/MMBtu the previous weekend (6 February). Prices weakened early in the week on mild weather forecasts but rose mid-week on expectations of large storage withdrawals. Gains were limited after the EIA reported a smaller-than-expected draw, keeping prices in the low-USD 3s/MMBtu range through the end of the week. The EIA reported US gas inventories at 2,214 Bcf as of 6 February — down 249 Bcf week-on-week, 4.2% below last year and 5.5% below the five-year average.

(16 February 2026 Updated)

Source: JOGMEC