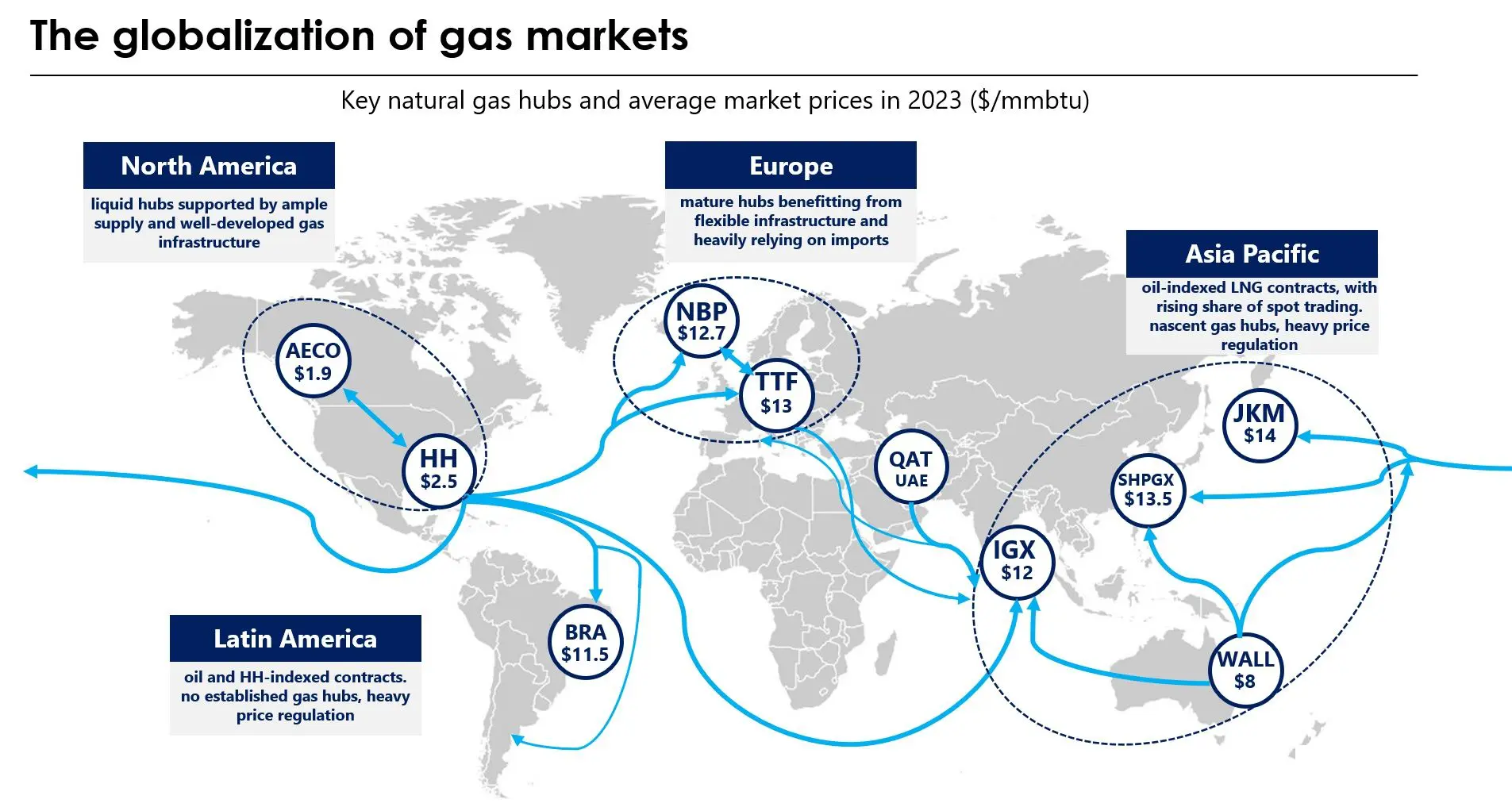

Dynamics this winter are consistent with a ‘regime shift’ taking place in the LNG market… with important implications for LNG asset value and global gas & power prices.

The LNG market has kicked off 2021 by smashing records. An acute shortage of cargoes in Asia across Jan & Feb has seen cargoes transacting near 40 $/mmbtu and spot charter rates surging to 350k $/day. These extreme price dynamics come less than 9 months after record low prices.

So far surging prices have been contained within the current winter horizon and started to ease late last week. JKM forward prices are in steep backwardation, with prices back under 7 $/mmbtu by April. But explosive price dynamics this winter are consistent with an important ‘regime shift’ taking place in the LNG market.

The supply & demand balance over the next 5 years is set to significantly tighten versus the 5 years we have just experienced. And that will have some important implications for LNG asset value as well as for European gas & power prices.

Source: This is a brief extract. See full article by Timera Energy

Follow on Twitter:

[tfws username=”TimeraEnergy” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]