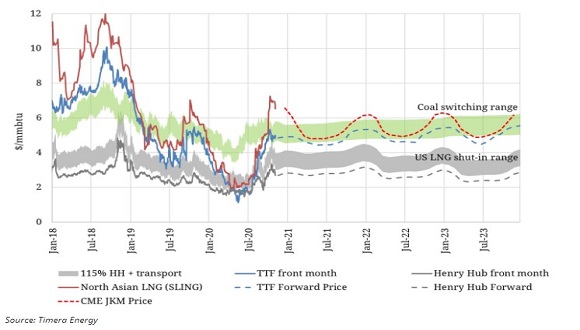

Higher international prices continue to work to the favor of U.S. LNG exporters. The spread between Asian and American prices currently stands at around $32 – even increasing shipping prices (as a result of the pandemonium at the Panama Canal and the increased demand for LNG in a time of low supply) will be unable to erase the huge margins exporters stand to gain from the wide netback.

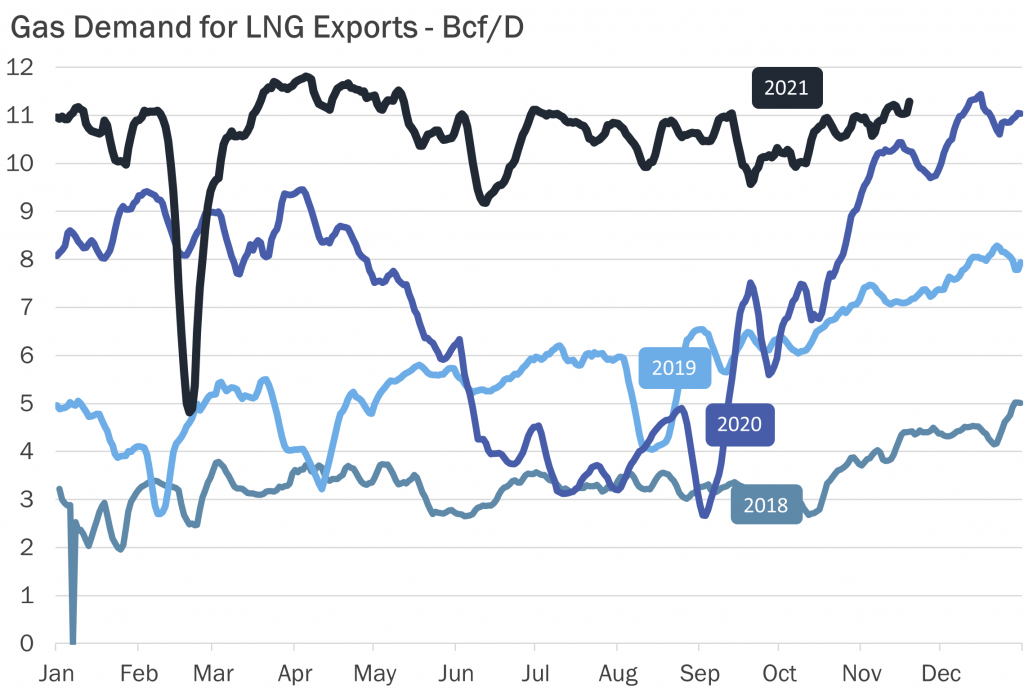

Freeport LNG, which was down around 0.5 Bcf/d throughout the week in order to conduct maintenance on one of its pre-treatment trains, is now back at its full operational capacity. American LNG exports have risen past the 11 Bcf/d mark on its return, and are expected to retain this level throughout the winter.

Both Sabine Pass Train 6, as well as Calcasieu Pass, are expected to come online towards the end of the winter season and are anticipated to increase U.S. total export capacity to around the 13 Bcf/d mark.

Given that current market conditions last, it is likely that these facilities will be operating at full capacity as soon as they are brought online.

Source: Gelber and Associates