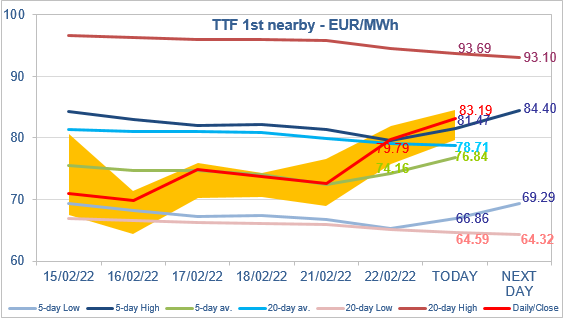

The gas market soared 47 cents higher today, taking back lost territory from yesterday’s price collapse rather quickly. Expectations for a lower than average storage injection this week are in line with the market’s upwards move today.

G&A anticipates a 92 Bcf injection – this undercuts the five-year average by around 12 Bcf. Over the week of storage, the market has observed a 0.82 Bcf/d w-o-w change in LNG exports as well as a 0.3 Bcf/d w-o-w change in production.

Gas generation’s role in the fuel mix has declined over the week after lower wind generation saw average gas generation spike up to higher than 160,000 MWh last week. Lower gas demand in the power markets is expected to ease some tightness in the market, as overall demand gains overtook those of supply this week.

Looking a few weeks ahead into the storage forecast, it is evident that incoming 2022 storage injections will outpace those of the five-year average and the 2021 injection average.

A large reason behind the decline of both averages post-mid-June is the reclassification of 51 Bcf of working gas to base gas at PG&E last year.

As a result of the reclassification, natural gas storage has a rare opportunity, where if weather forecasts hold, the current storage deficit to the five-year average can be drawn down.

Such a reduction in the storage deficit would result in a marginal decline in upwards price pressure.

Source: Gelber and Associates