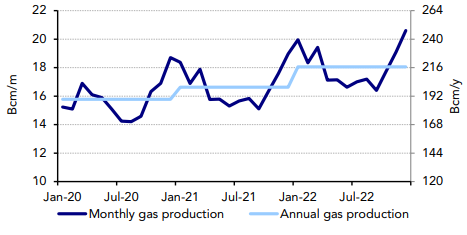

Domestic gas production for China is forecast to rise between 5% and 10% per year in 2021 and 2022. Increasing production from offshore fields is a central component of the Chinese government’s plans to meet climate goals.

Much of the increase in production is expected to come from conventional gas resources since the infrastructure and water supplies needed to extract gas from shale deposits will be insufficient in the short to medium term.

Gas production in China is forecast to rise from 190 Bcm/y in 2020 to 200 Bcm/y by 2021 and 216 Bcm/y in 2022. Drilling in the deepwater fields in the South China Sea will be the focus where CNOOC claims to have a “mega gas zone” with 1 trillion cubic meters of gas reserves.

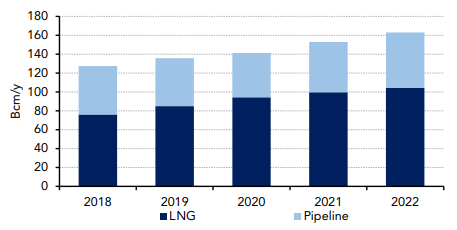

Historically, a rise in domestic gas production did not displace LNG imports but, rather, pipeline imports.

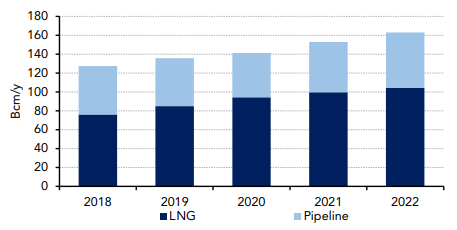

Pipeline imports have declined from 2018 to 2020, but that trend is forecast to reverse in the outlook. Pipeline imports are forecast to increase from 47 Bcm/y in 2020 to 53 Bcm/y in 2021 and 58 Bcm/y by 2022.

As the Power of Siberia has ramped up volumes since operations began, pipeline imports from Turkmenistan and Uzbekistan have declined due to production issues in both countries. Since early January, China has increased imports via the Power of Siberia by double the contractual volumes due to higher winter demand in 1Q.

Despite the expected rise in domestic production and pipeline imports, LNG imports are still expected to grow by 5% per year out to 2022 as demand growth continues at a fevered pace. LNG imports are forecast at roughly 100 MMt/y in 2021 and 105 MMt/y in 2022.

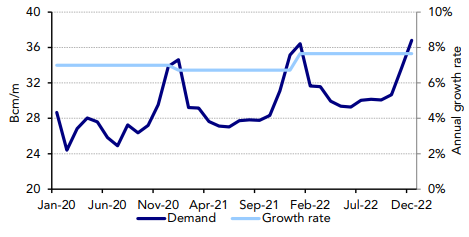

Natural gas demand is forecast to grow between 7% and 8% per year out to 2022 which is driving the increase in pipeline and LNG imports. Demand from the city gas sector grew in 2020 to record 35 Bcm/y, but was flat in the industrial, power and petchem sectors at 208 Bcm/y.

With the combination of a strong economic recovery and shift to cleaner-burning fuels in the power sector, natural gas from the sectors is forecast to increase over 2020 totals in the outlook. Demand is forecast at roughly 350 Bcm/y in 2021 and 380 Bcm/y in 2022.

Source: Poten & Partners