Russian gas deliveries to Europe at multi-year lows, extreme heat in many parts of the continent, growing constraints to coal supply in Germany and French nuclear output cuts amid low river levels – all this illustrates where the region´s gas market has found itself in mid-summer 2022.

The list could go on and on, but even now one can identify some developments that bring light into this darkness. Among them in particular are persistently robust LNG imports to the European terminals during this injection season.

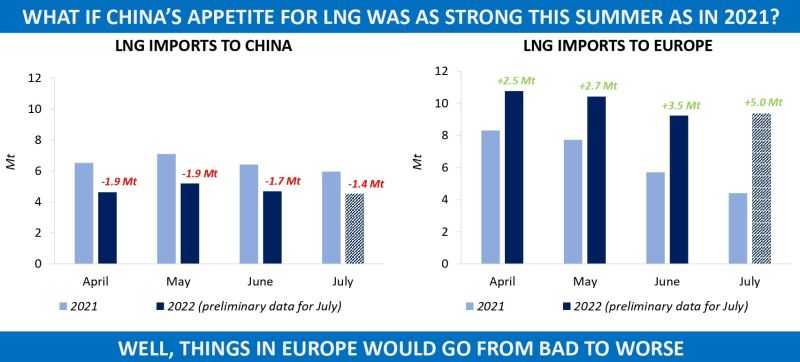

It would be very difficult for regional buyers to sustain high levels of liquefied gas intakes without ‘the assistance’ of Chinese importers. Abundant LNG storage inventories in Northeast Asia along with a new wave of Covid restrictions and the slowdown in China´s economic growth resulted in the country’s regasification facilities receiving on average 4.8 million tons per month between April and June 2022, or 1.8 million tons less than the previous year, according to Kpler.

Now imagine how the situation with LNG supply in Europe would have evolved if China´s demand for spot cargoes had been as strong as in 2021? In that case, LNG monthly imports to Europe would have not automatically decreased by 1.8 million tons, but buyers across the region would have lost a significant portion of volumes available in the global market.

With limited pressure coming from Chinese competitors, LNG deliveries to the European sites increased by around 3 million tons per month YoY in the second quarter of 2022. In July, imports could experience an YoY growth of 5 million tons.

The question that remains open is whether buyers from China become much more engaged in competition for spot cargoes in the second half of this year. It depends on many factors, including if it will take much time for Chinese economy to fully recover from lockdowns, what level the country’s LNG stocks will stand at in a few months´ time and to what extent contractual volumes will cover local buyers’ need for liquefied gas until the end of the year. So far in July 2022, China has imported about 500 thousand tons less than the same time last year.

Source: Yakov Grabar (LinkedIn)