If you look at how the global LNG market has been developing throughout most of 2021, you will find it has similarities with the way European football leagues unfold.

For much of the season, there are typically many clubs challenging for the EPL, Serie A, Bundesliga, La Liga or Ligue 1 titles, like there were multiple buyers competing for available cargoes up until Q4.

But as the final part of competition approaches, a list of title contenders is often narrowed down to just two clubs, which in terms of the LNG market are Northeast Asia and Europe.

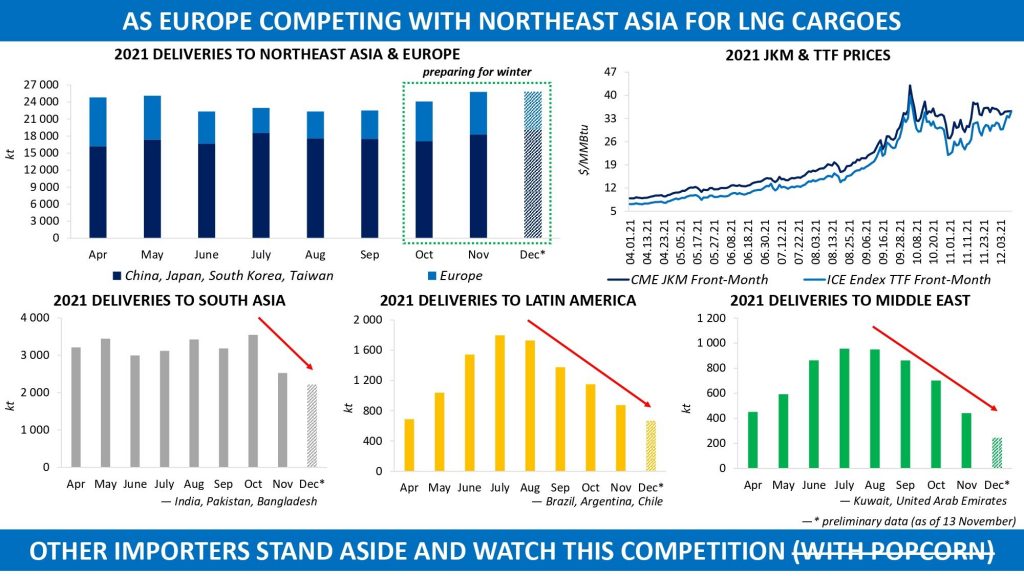

As recently as in mid-Q3, large quantities of LNG, including a substantial amount of spot cargoes, were directed outside Europe amid unprecedented demand in other parts of the globe. In August, LNG imports to South Asia, Latin America and the Middle East totaled about 6 million tons, while only 4.7 million tons were delivered to the European terminals during that month, according to Kpler.

Seasonally stronger consumption in those regions, paired with restricted power generation from some alternative energy sources, deprived Europe of a significant portion of seaborne volumes.

As Q4 was coming closer, things started to change with once active buyers in the spot market stepping aside one after another and Europe recovering the lost ground in the LNG importers league. Between August and November, cargo deliveries at the regas facilities in South Asia, Latin America and the Middle East fell by approximately 40pc, while a record jump in prices at European gas hubs resulted in a 60pc rise in LNG imports to the NWE and Mediterranean ports over the same period.

Outside of Northeast Asia and Europe, some buyers had to restrict imports in a high-price environment and switched to other fuels, as in the case of Chile that found in gasoil a substitute for LNG. Others, like Middle Eastern players, cut their purchases due to lower demand for air conditioning, after a peak in July and Aug. Even Brazil had to retreat to the sidelines, with the need for LNG decreasing to a four-month low in November against the backdrop of increased hydroelectric power generation.

Intense competition on the global LNG market is now happening between buyers in Northeast Asia and Europe. Although the former were managed to build up above-average inventories at the LNG terminals in the lead-up to the coldest months in the Northern Hemisphere, La Niña threatens to strain supply in Asia-Pacific. As for the latter, stable LNG inflows are of particular importance to Europe, given record low stocks of gas in the underground storages.

By and large, the winner of the competition between the two regions is known well in advance. However, again making a parallel between the LNG market and European football, unexpected events occasionally occur, as happened with Leicester City’s 2015/16 Premier League title or LOSC Lille’s 2020/21 Ligue 1 title win 😉

Source: Yakov Grabar (LinkedIn)