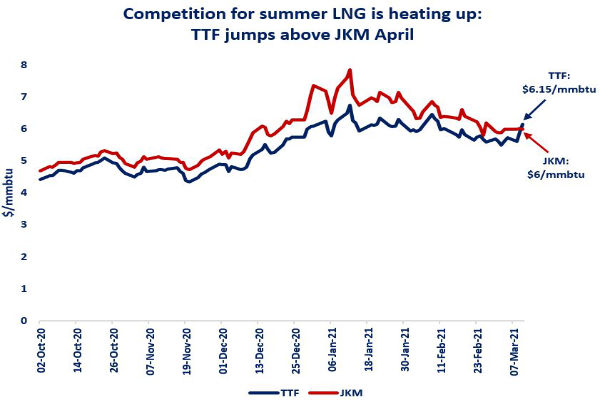

TTF prices gained almost 15% since the beginning of March, supported by a heavy maintenance schedule in Norway and the continuing carbon price rally, with ETS hitting an historical high of €41.5/tCO2eq.

What does it tell us about the summer LNG market? Could we see more LNG coming back to Europe?

European LNG imports practically dried up through the winter season, plummeting by 33% yoy since the beginning of October, as LNG cargoes have been seeking the Asian premium.

A number of factors could support higher LNG imports through the summer:

(1) European storage sites dried up with inventories almost 25 bcm lower compared to last year, which will increase injection needs;

(2) Norway’s heavier maintenance schedule will limit a strong Norwegian recovery in pipeline supplies;

(3) Carbon prices at over €40/t could provide some additional market space for gas-fired power plants in the thermal stack;

(4) The strong recovery in oil prices could weigh on the competitiveness of oil-indexed legacy pipeline contracts in Q2/3.

What is your view? How will LNG dynamics play out this summer? Will we see more LNG imports flowing into Europe

Source: Greg Molnar

See original post by Greg at LinkedIn.