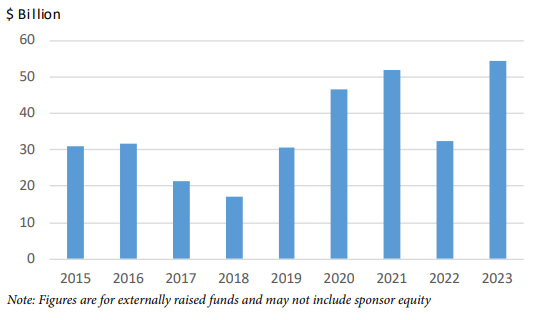

Liquefaction financing jumped to a new record of $54 billion in 2023, propelled mostly by three multi-billion-dollar US transactions.

The figures were boosted by the completion of project finance deals for NextDecade’s Rio Grande LNG Phase 1, Sempra’s Port Arthur Phase 1 and Venture Global’s Plaquemines Phase 2. Adding to the total were a slew of large bond offers that were mostly used to refinance bank debt for US projects.

US liquefaction funding in 2023 was almost double the next highest yearly US total of around $27 billion seen in 2019. There was very little liquefaction fundraising outside the US, except in Australia for EIG’s LNG unit, MidOcean Energy, which sought to purchase Origin Energy’s integrated gas business – although this deal subsequently fell through.

At $54 billion, liquefaction funding in 2023 edged above the next highest year – the $52 billion seen in 2021.

That year’s strong showing came in part from a $12.5 billion QatarEnergy bond issue and a €9.5 billion ($10.75 billion) project finance deal for the Arctic LNG 2 project in Russia, along with a steady stream of US project refinancings.

In 3Q 2023, developer NextDecade closed the largest ever single-phase financing for a US project when it secured $11.6 billion in bank debt and a smaller, $700 million bond offer for its 17.5-MMt/y Rio Grande LNG project.

Source: Poten & Partners