Natural gas May futures as of publication are down $0.01/MMBtu to $2.23/MMBtu, but have been in and out of positive territory this morning (May 9).

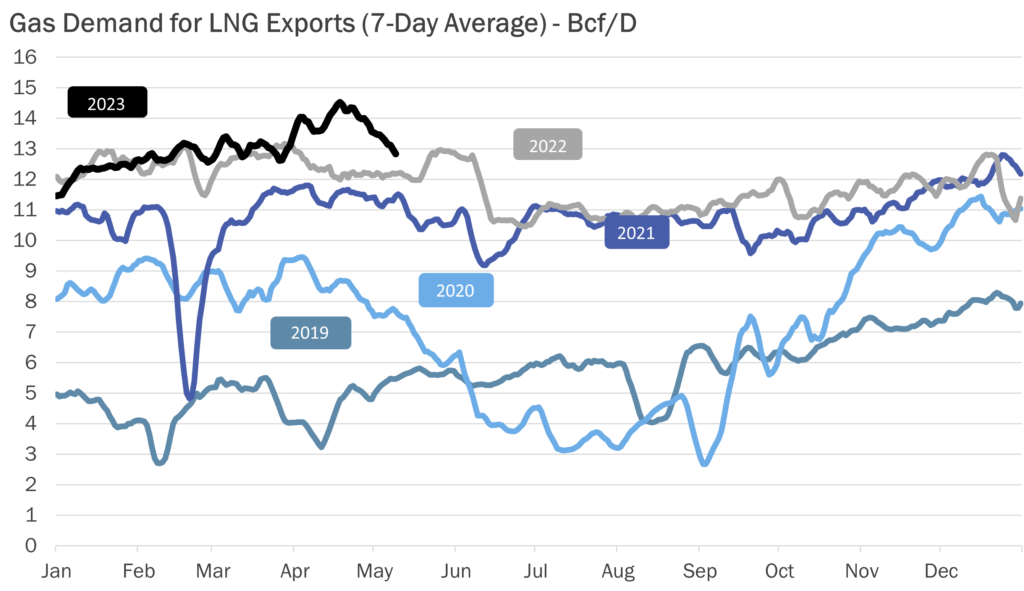

Gas flows to US LNG export plants have dropped to near 12 Bcf/D so far, continuing the decrease from the highs in April.

Just about every export terminal has reported reduced flows going into the terminals signaling that maintenance season is underway.

Cameron LNG still has reduced flows, Corpus Christi LNG appears to have a train offline, and similarly Sabine Pass and Calcasieu have approximately 1 Bcf/D of reduced flows combined.

Freeport is the only terminal that does not appear to be doing maintenance at the moment and remains at its highs.

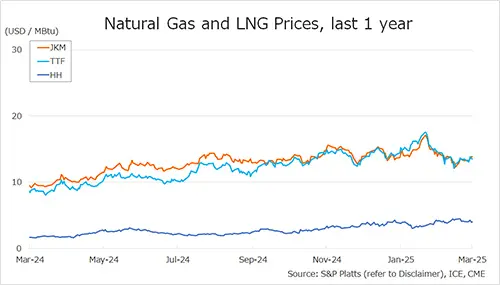

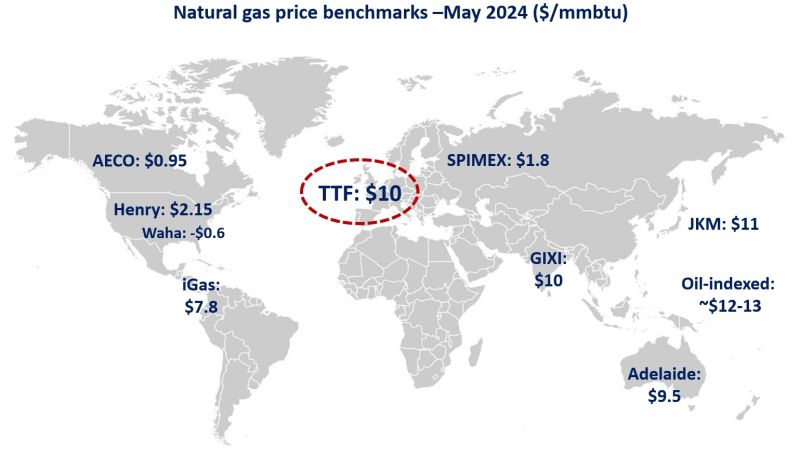

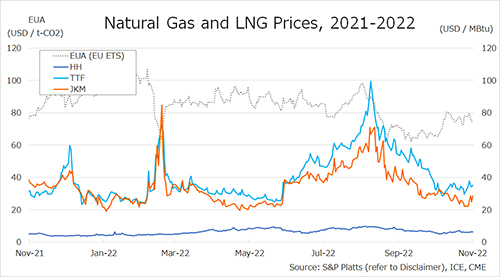

In other news, Europe’s economy is getting a boost from the decline in the price of the fuel used for power generation and heating to levels not seen since 2021 at $11.94/MMBtu.

While this price slump may not last much longer, gas storage facilities are about 61% full and fears of an energy crisis like the one seen last summer are not present.

European storage is almost twice as full as it was at this time last year meaning that the scramble to fill storage for the winter is likely to not happen two years in a row.

With Europe showing a continued interest in ensuring energy security following Russia cutting off the Nordstream 1 pipeline.

Source: Gelber & Associates