On paper, it is pretty much similar to the previous one signed with Sinopec, so no signs of favoritism. Highlights include:

4 mtpa over 27 years

They also have a 5% stake in one LNG train.

This is the third deal signed for the expansion of Qatar’s LNG, two Chinese companies and Petrobangla (although the duration of the Petrobangla contract as well as the size were smaller).

Is there a third large 4 mtpa contract in sight with the third Chinese NOC?

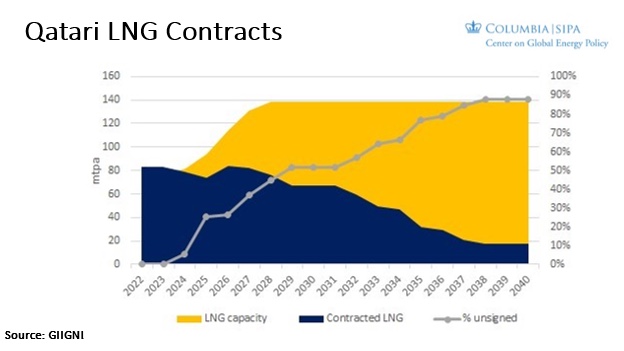

As we wrote earlier this year with Ira Joseph, it will be crucial for any company targeting an FID over 2023-24 to observe Qatar’s contracting strategy. They still have significant quantities of LNG to sell as you can see on the attached graphic

From the Chinese point of view, diversion of LNG suppliers is absolutely crucial in the current geopolitical environment.

If the Qataris move aggressively on full disclosure and reduction of methane emissions, that could become a very interesting environment given the upcoming EU methane strategy.

Source: Anne Sophie CORBEAU, Global Research Scholar at Center on Global Energy Policy