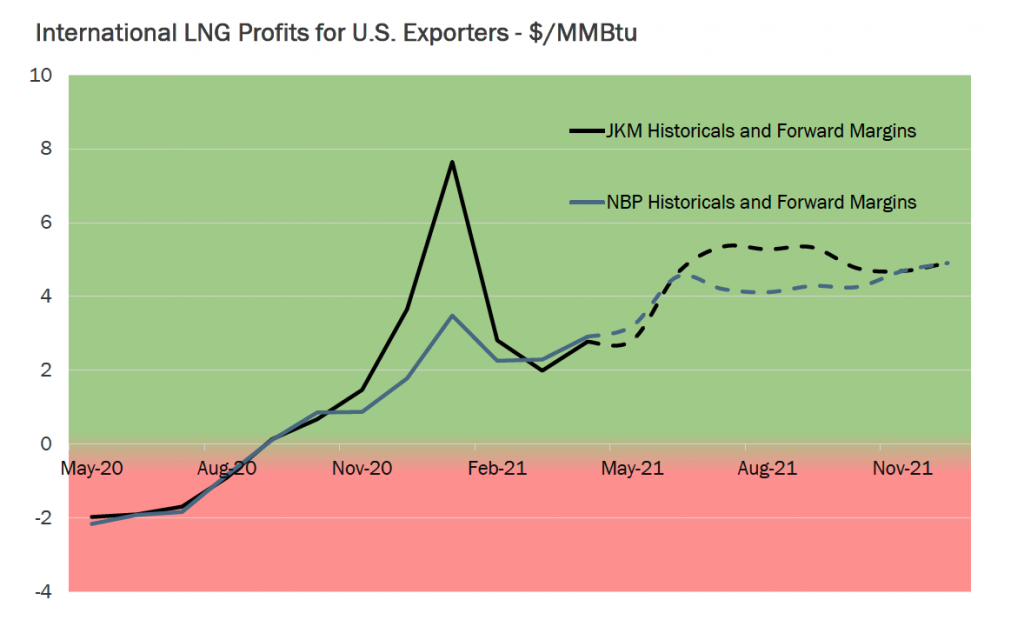

LNG production margins from the US Gulf Coast to markets around the world varies day by day due to fluctuations in charter costs, agent and insurance fees, and canal costs. The chart shown above seeks to capture the cryo-spread between the Henry Hub and the JKM (Japan-Korea Marker) as well as the NBP (National Balancing Point in the UK) – it should be noted that regasification and liquefaction fees were not factored in this calculation.

On average, Henry Hub forwards trade at nearly a $4.5 discount to the NBP and the JKM. In the past, there have been instances where the margin has completely vanished, like in summer 2020 when international prices converged, as well as instances where extreme dislocations can be noted, such as in winter 2020 when the JKM soared to over $20/bbl in response to high Asian winter demand.

Currently, international forward benchmarks remain elevated and lower than normal European storage levels will give exporters incentive to ship to Europe in the coming summer.

Breakeven spreads to the NBP remain positive, and are higher than those of the JKM in May through July. However, forward markets indicate that European prices will fall to their traditional $6-7 range beyond the current storage injection season and scede the advantage to Asian destinations next winter.

Regardless of these outcomes, there is little probability for cargo cancellations from the US given the strong summer profit opportunities available for Gulf Coast shippers in both Asia and Europe.

Source: Gelber & Associates