Portugal is running out of options to meet the strong demand for natural gas driven by frigid weather during the 2020-2021 winter. Parts of the country are already facing shortages of the fuel, and the situation is set to deteriorate during the rest of the season.

Weather is expected to favour gas consumption in Portugal in Q1 2021, which will worsen the country’s gas supply tightness. Preliminary weather forecasts suggest average temperatures in Portugal for Q1 2021 compared with 2C above-average temperatures seen during the same quarter in 2020.

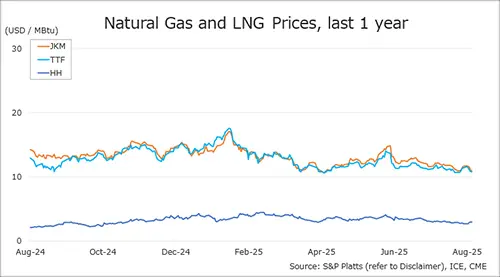

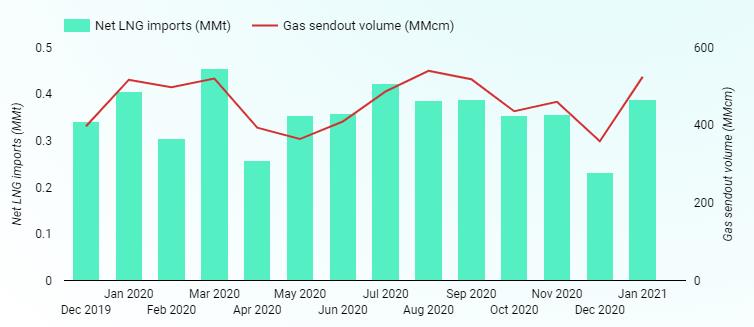

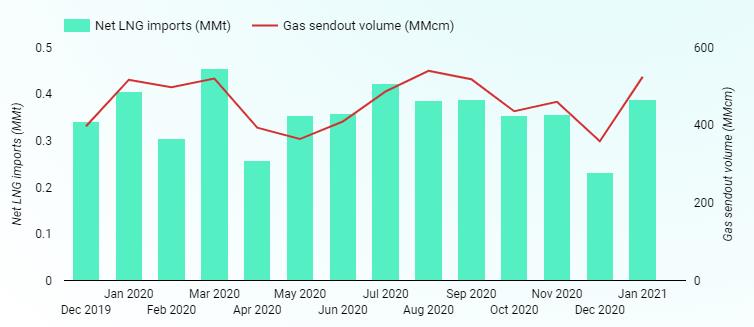

Figure 1: Portugal’s monthly LNG imports. Source: Energy Projections European Union LNG imports dashboard

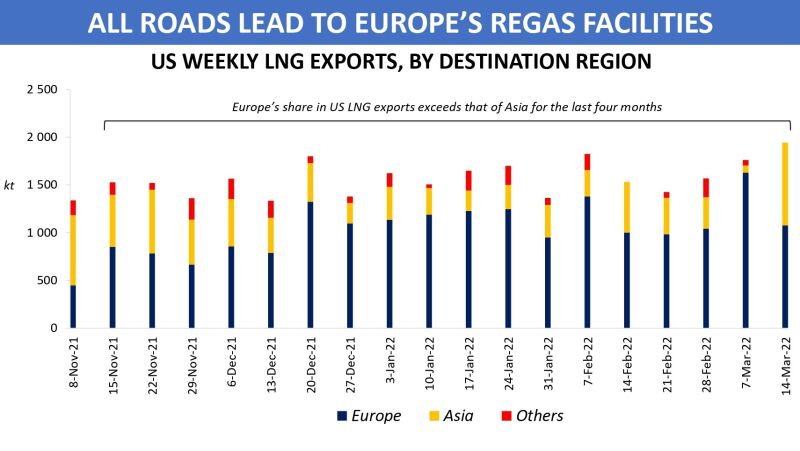

The country has little option but to rely on spot LNG despite the high prices of the fuel. This is also a risky alternative because there is no guarantee that LNG cargoes can be secured when need be given the current tight spot market.

Regasified LNG is Portugal’s largest source of gas supply. The country purchases most of its LNG under long-term contracts, but it also counts on the spot market to meet spikes in gas demand especially during winter. Portugal imported 0.62 million metric tonnes (MMt) of LNG between 01 December 2020 and 31 January 2021, which was a year-on-year fall of just over 17%.

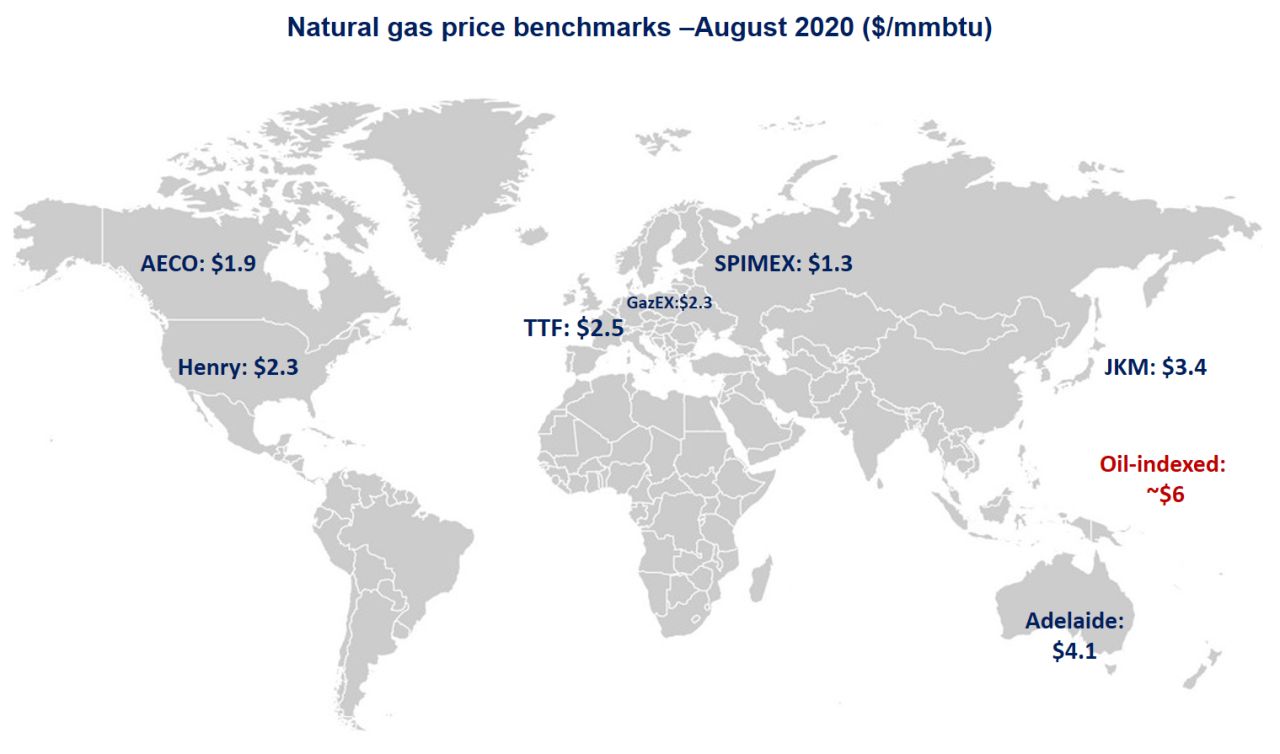

Persistently high LNG prices have weighed on Portugal’s LNG uptake. The price of spot LNG for Europe’s Atlantic Coast averaged $8.1/MMBtu for the week ending 31 January 2021, according to Energy Projections’ price assessment. This is a sharp increase from the average of $3.9/MMBtu for the same week in 2020.

Europe’s Atlantic Coast spot LNG price has witnessed significant falls over the past two weeks, but the declines have not yet been sufficient to reinvigorate Portugal’s uptake of the fuel. Energy Projections’ assessment indicates the spot price averaged $18.3/MMBtu for the week ending 17 January 2021.

Portugal is depending heavily on its gas inventories, which are already significantly depleted, to meet demand. This option alone is unlikely to see the country through to the end of the winter. Portuguese gas storage sites were only 58% full on average between 01 December 2020 and 31 January 2021, much lower than the average fullness of 93% during the corresponding 2019-2020 period.

Portugal also relies on the pipeline gas flow via Spain to meet winter demand for the fuel. However, Spain itself is grappling with the problem of high gas consumption because of cold weather, together with limited LNG supply due to skyrocketing prices of the fuel.

Consequently, the gas supply to Portugal via Spain amounted to 58 million cubic metres (MMcm) between 01 December 2020 and 31 January 2021, marking a sharp decline of approximately 43% compared with the corresponding 2019-2020 period.

Author: Energy Projections

Connect with Energy Projections on LinkedIn