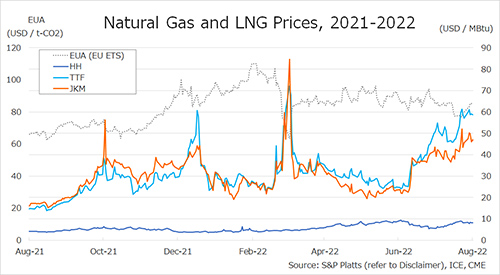

The Northeast Asian assessed spot LNG price JKM for the previous week (25 July-29 July) fell to USD 41/MBtu on 25 July from USD 43/MBtu the previous week.

JKM then rose to USD 52/MBtu on 27 July on the back of supply concerns in Europe and tightness of spot cargo availability in the Asian market, but fell to USD 43/MBtu on 28 July in line with lower European gas prices.

On 29 July, JKM rose to USD 46/MBtu due to increased trading activity in preparation for winter demand.

The European gas price TTF rose to USD 61.3/MBtu on 27 July from USD 47.2/MBtu the previous week as supply concerns spread in the market ahead of further Russian gas supply cuts to Nord Stream by Gazprom, which were expected after 27 July.

TTF fell to USD 58.9/MBtu on 28 July and USD 57.1/MBtu on 29 July as market participants remained quiet to assess the direction of prices.

After the end of scheduled maintenance, the Russian gas supply to the Nord Stream has dropped from 40% to 20% of capacity.

The U.S. gas price HH rose to USD 9.0/MBtu on 26 July from USD 8.3/MBtu the previous week, but fell on 27 July to USD 8.1/MBtu. 29 July saw a slight increase to USD 8.2/MBtu.

Above-normal temperatures in the U.S. have led to an increase in natural gas consumption.

According to EIA’s Natural Gas Storage Report released on 28 July, U.S. natural gas underground storage as of 22 July totaled 2,416 Bcf, up 15 Bcf from the previous week, down 10.8% from the same period last year, and down 12.5% from the historical five-year average.

Updated 01 August 2022

Source: JOGMEC