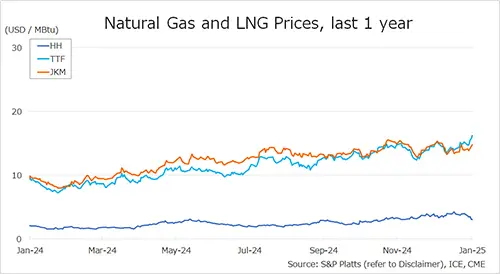

Global gas prices up in all key markets: Polar vortices, strong demand growth boosted gas prices well above last year’s levels across all key gas demand regions.

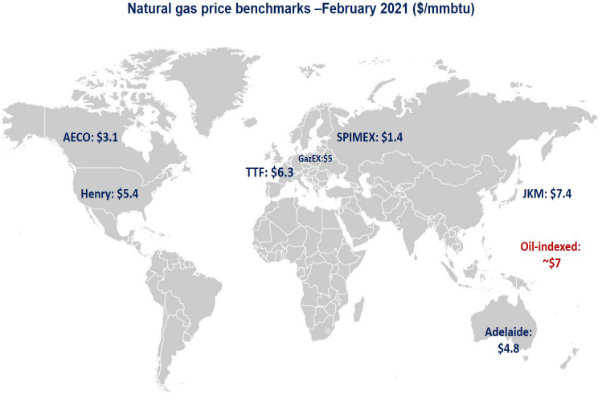

In the US, Henry climbed to an historical record of $23.96/mmbtu at the height of the big freeze and averaged at $5.4/mmbtu through Feb, its highest level since Feb2014, the last visit of the polar vortex.

As a result of wellhead freeze-offs US production fell by close to 10% yoy, whilst consumption was up by over 8% leading to massive storage withdrawal (almost doubled yoy).

Strong US gas demand boosted net imports from Canada by an estimated 20% and provided support to AECO rising over $3/mmbtu.

In Europe, TTF more than doubled yoy, to an average of $6.2/mmbtu. Colder temperatures in the first half of the month, together with low wind speeds have been driving gas demand up by over 6% yoy, whilst LNG flows were down by one-third.

In Asia, JKM moderated from its Jan highs to $7.3/mmbtu, still a twofold increase compared to last year. low storage inventories at the beginning of the month, together with strong demand growth in China (over 10% yoy) increased northeast Asian LNG imports by 18% yoy.

What is your view? How will prices evolve as we are heading out of the heating season? How do you see the JKM-TTF spread this summer?

Source: Greg MOLNAR

Join the debate with Greg on LinkedIn.