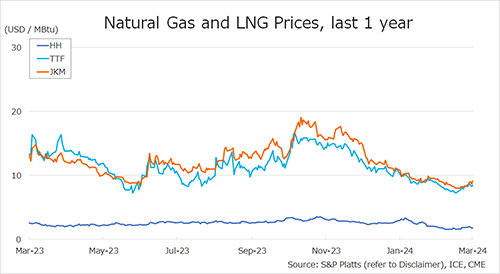

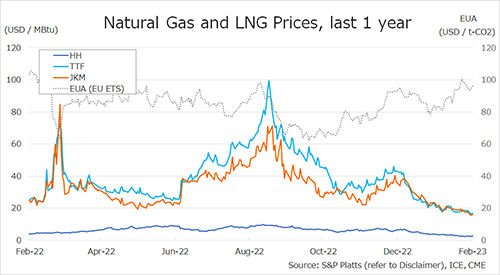

The Northeast Asian assessed spot LNG price JKM for the previous week (6 February – 10 February) fell for four consecutive business days from USD 18/MBtu the previous week to late USD 15/MBtu on 10 February on bearish sentiment toward a recovery in Chinese LNG demand, expectations for the restart of U.S. Freeport LNG, weak demand due to a warm winter, and high inventory levels.

On 10 February, JKM rose to USD 16/MBtu on buying interest in China and South Asia on the back of LNG price declines.

According to METI, Japan’s LNG inventories for power generation totaled 2.42 million tonnes as of 5 February, down 0.11 million tonnes from the previous week, up 0.73 million tonnes from the end of the same month last year and up 0.44 million tonnes from the average of the past five years.

The European gas price TTF fell for four consecutive business days to USD 16.6/MBtu on 9 February from USD 18.6/MBtu the previous week on the back of expectations for the resumption of Freeport LNG operations, strong UK wind power generation, and firm European underground gas storage due to a mild winter.

On 10 February, despite reports of reduced gas supply from Norway, the firm underground gas storage levels and strong UK wind power generation kept European gas prices modestly higher, at USD 16.9/MBtu.

ACER published the 10 February spot LNG assessment price for delivery in Northwest Europe at EUR 53.85/MWh (USD 16.87/MBtu), up EUR 0.04/MWh from the previous week. According to AGSI+, the average European underground gas storage level as of 10 February was 66.93%, down from 70.76% the previous week.

The U.S. gas price HH rose for two consecutive business days to USD 2.6/MBtu on 7 February, rising from USD 2.4/MBtu the previous week due to forecasts of cooler temperatures in the western and southern parts of the U.S.

The price then declined to USD 2.39/MBtu on 8 February backed by higher-than-expected temperatures on the U.S. East Coast, but increased slightly to USD 2.43/MBtu on 9 February.

The next day, HH rose to USD 2.5/Mbtu on a bullish storage report and progress at U.S. Freeport LNG. According to the EIA Weekly Natural Gas Storage Report released on 9 February, the U.S. natural gas underground storage on 3 February was 2,366 Bcf, down 217 Bcf from the previous week, up 10.9% from the same period last year, and up 5.2% from the historical five-year average.

According to METI, Japan’s LNG inventories for power generation

Updated 13 February 2023

Source: JOGMEC