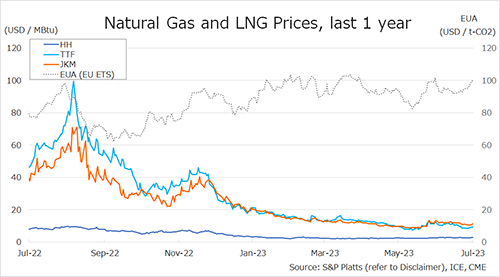

The Northeast Asian assessed spot LNG price JKM for the previous week (17 July – 21 July) fell to the low USD 10s on 17 July from USD 11/MBtu the previous week due to ample inventories and supply of prompt cargoes by tenders.

JKM then hit the low USD 10s for three consecutive business days, before rising to the low USD 11s on 21 July due to supply concerns increased due to scheduled maintenance at certain gas plants and multiple outages.

According to a 19 July METI release, Japan’s LNG inventories for power generation totaled 2.10 million tonnes as of 16 July, up 0.02 million tonnes from the previous week, down 0.18 million tonnes from the end of the same month of last year and up 0.02 million tonnes from the average of the past five years.

The European gas price TTF fell to USD 8.3/MBtu on 17 July from USD 8.5/MBtu the previous week as most of Norway’s gas-related facilities completed maintenance.

TTF then rose to USD 8.9/MBtu on 18 July due to higher temperatures in Europe. On 20 July, TTF rose to USD 9.2/MBtu amid concerns of reduced output at the French nuclear power plant caused by high river temperatures and planned maintenance, and was almost unchanged at USD 9.2/MBtu on 21 July.

ACER published the 21 July spot LNG assessment price for delivery in the EU at EUR 26.7/MWh (equivalent to USD 8.7/MBtu). According to AGSI+, the European underground gas storage rate as of 21 July was 83.0%, up from 81.1% the previous week.

The U.S. gas price HH rose slightly to USD 2.7/MBtu on 21 July from USD 2.5/MBtu the previous week, although there were some ups and downs. According to the EIA Weekly Natural Gas Storage Report released on 20 July, the U.S. natural gas underground storage on 14 July was 2,971Bcf, up 41Bcf from the previous week, up 24.0% from the same period last year, and up 13.8% from the historical five-year average.

Source: JOGMEC