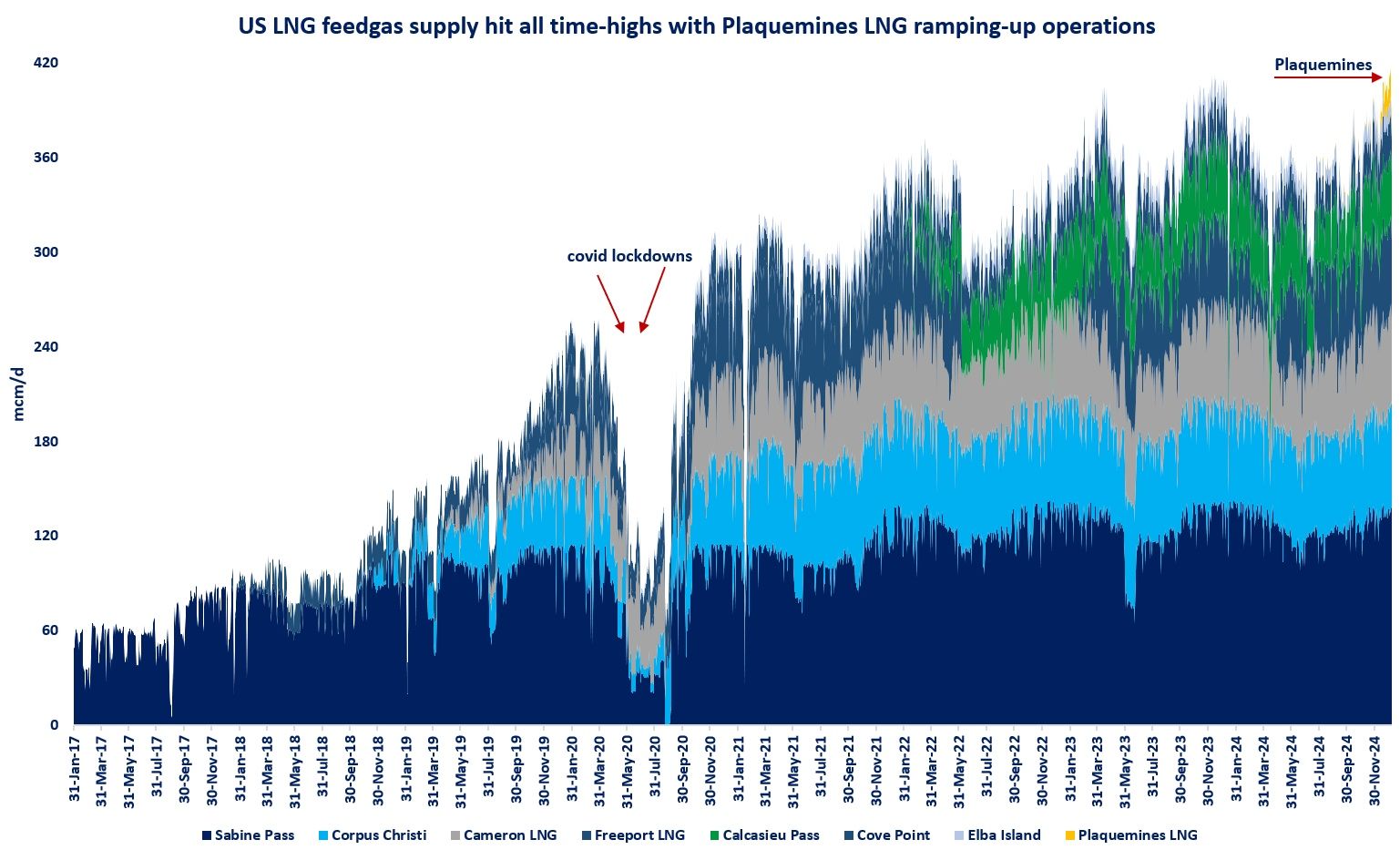

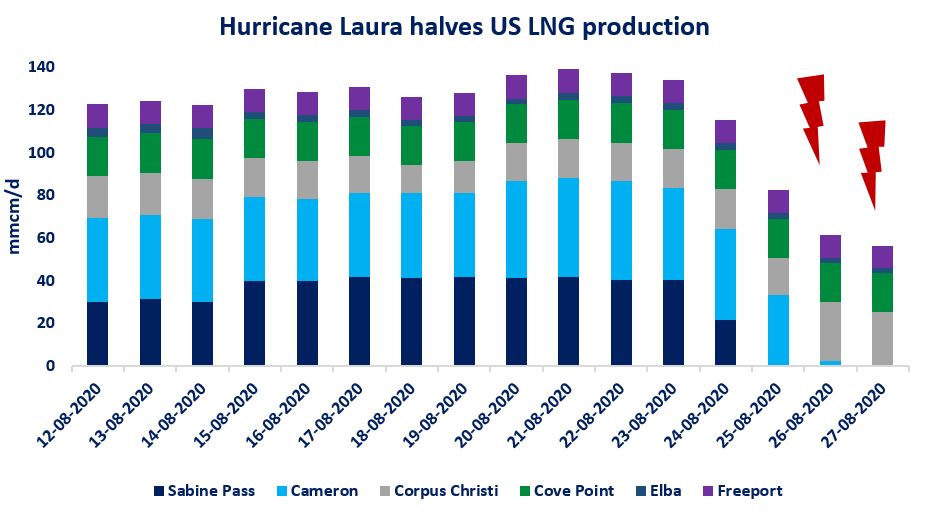

(Greg MOLNAR) Hurricanes vs LNG: over half of US LNG production has been cut amidst the arrival of Hurricane Laura, the strongest in Louisiana’s history since over a century.

With Sabine Pass and Cameron LNG terminals completely shut-down, half of US liquefaction is out of service, accounting for approximately of 8% of global capacity.

Considering the pre-hurricane production rates, about 5-6 cargoes could be lost if the terminals remain out of service by the end of this week.

Together with the operational issues at Gorgon T2 and Qatargas 2 T4 being allegedly offline this week, over 10% of the global liquefaction capacity is unexpectedly shut.

This certainly contributes to the tail-end firming up of TTF and JKM, up by 15% and 7% respectively, since Hurricane Laura hit the US. and this shows us, how the market is oversupplied: the sudden loss of 8% of global liquefaction capacity could have easily translated into a more virulent price reaction under tighter market conditions.

The main uncertainty if the Hurricane caused any long-lasting damages to Sabine Pass or Cameron LNG, which would contribute to firmer prices in the coming weeks.

See original post & connect with Greg Molnar on LinkedIn