The IEA just published Global Gas Security Review. 5 key takeaways include:

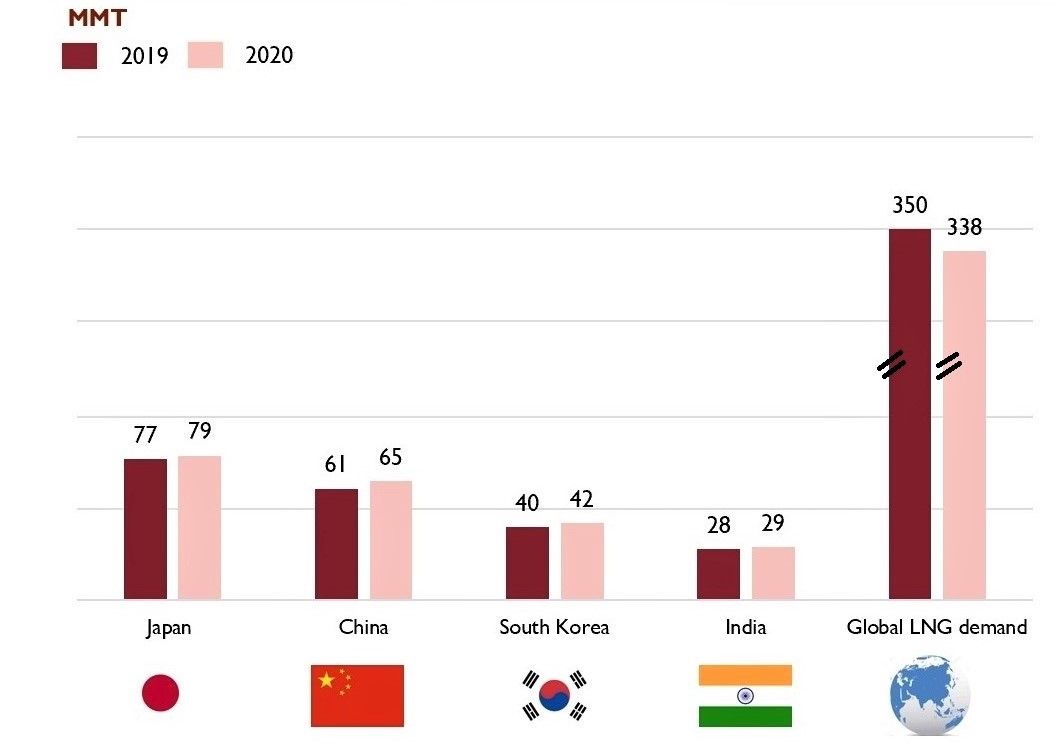

(1) Despite showing first signs of recovery in Q3, global gas demand is set to fall by an historical record of 120 bcm this year;

(2) In contrast with oil and coal, gas demand is expected to rebound to pre-covid levels in 2021 supported by the fast growing markets of Asia and the Middle East;

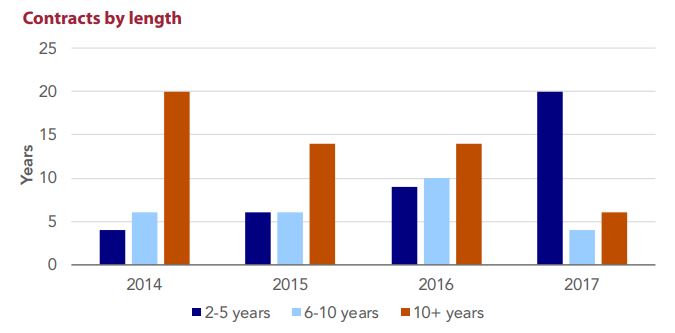

(3) LNG investments dried up and LNG contracting activity halved in 2020, falling to its lowest since 2009: will we see a recovery in 2021?

(4) One third of active LNG contracts (~200 bcm/y) are expected to expire in the next 5 years: a window of opportunity to negotiate more flexible contracts with a more diverse pricing structure;

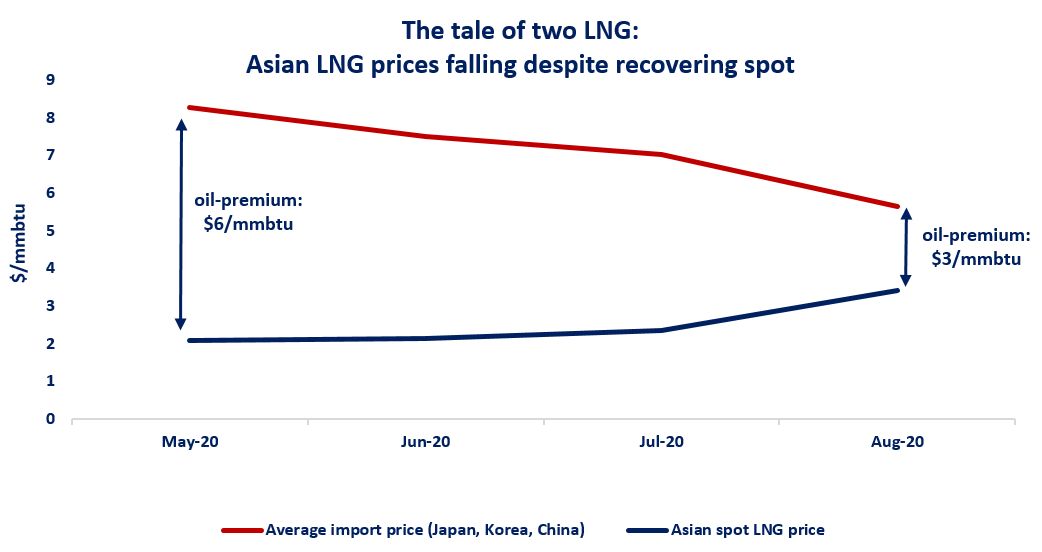

(5) Oil-indexation is loosing ground: our contract outlook suggest that the share of oil-indexed LNG volumes will drop from 70% in 2018 to just above 50% by 2025 in export contracts.

What is your view? Will we see a strong recovery in 2021? What are the main risks? How will contracting evolve? Could oil-indexation make a come back?

Connect with Greg on LinkedIn