Energy markets remain in disarray this morning as brutally cold weather keeps its grip on much of the central and southern US. The coldest weather for the country overall appears to have occurred yesterday and pressured residential and commercial heating demand alone to nearly 70 Bcf/d.

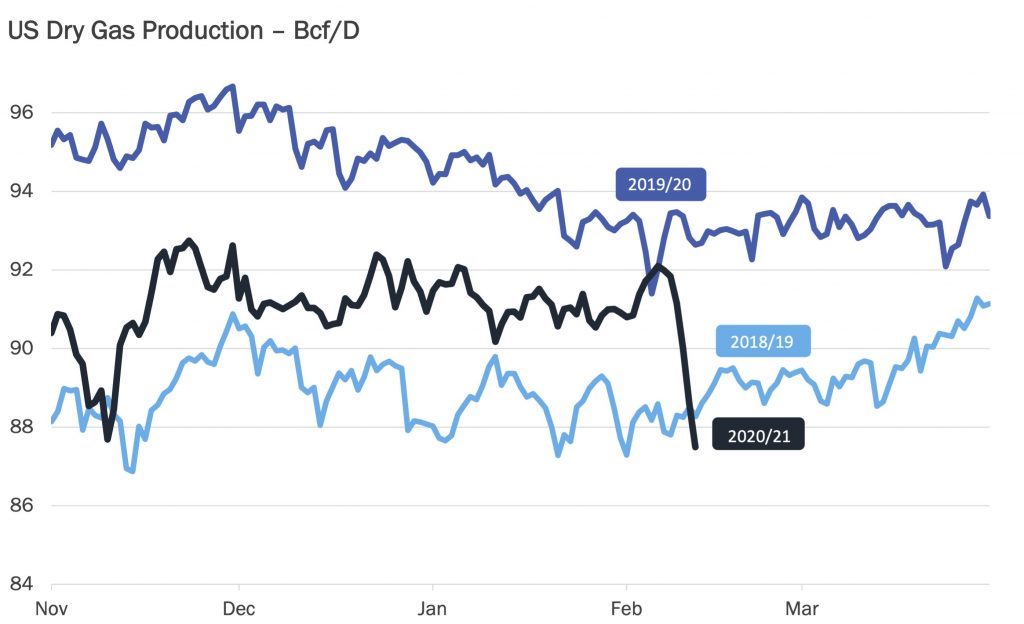

Simultaneously, production freeze-offs have reached dramatic levels in recent, with dry gas estimates slipping below 80 Bcf/d today, down nearly 13% since just last week. This double-whammy of peak demand and reduced supply has rocked physical markets and is resulting in still-widespread, triple-digit trading across Midcontinent and Western pricing locations.

Meanwhile, compared to obscenely high spot pricing, the action is natural gas futures remains relatively muted. After a brief spike above $3.20 early this morning (the front month’s highest level since very early November) the March contract is now satisfied coming out of the chaotic, long weekend about thirteen cents higher at $3.04/MMBtu.

Although the current two-week period will threaten a record for the largest withdrawal ever over the given timeframe, market participants appear to believe that the [former] storage surplus will be sufficient to carry it through this historic cold spell.

Additionally, temperatures are forecast to moderate towards normal by next Monday and expected to ease the current pressure on the market.

Source: Gelber & Associates

Follow on Twitter:

[tfws username=”GelberCorp” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]