The European gas market went through a profound transformation over the last two decades: traded volumes on TTF exploded, liquidity improved and trading is increasingly taking place on exchanges rather via OTC.

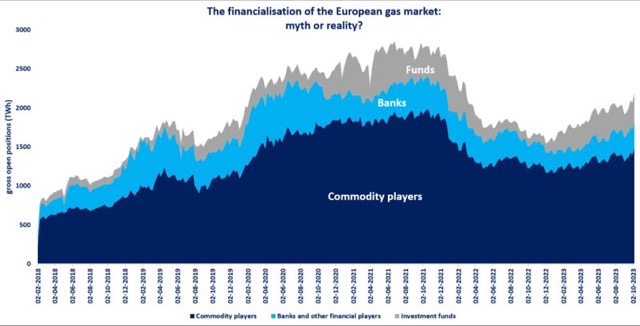

There is a widespread belief that the wild price swings of last year were exacerbated by financial players and their speculative trading strategies.

And this of course attracts a wide range of players beyond the traditional European utilities, who are using TTF to hedge their physical positions.

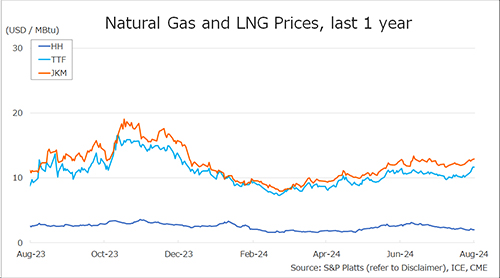

TTF became the “Global Gas Wheel” attracting Asian and North American players, as well as financial institutions/money managers who see it as a venue for investment/speculation with the hope of higher returns. their presence of course improves the hub’s liquidity as they serve as a counterparty for market players.

But have financial players caused the record price swings of last year? Data shows that financial players account for about 30% of gross positions and that they sharply reduced their exposure to TTF at the height of last year’s crisis.

Shows that financial players sharply reduced their exposure to TTF at the height of the crisis. This was especially true for investment funds.

What is your view? What is the impact of financial players on the European gas market? And how do they impact price volatility?

Source: Greg MOLNAR