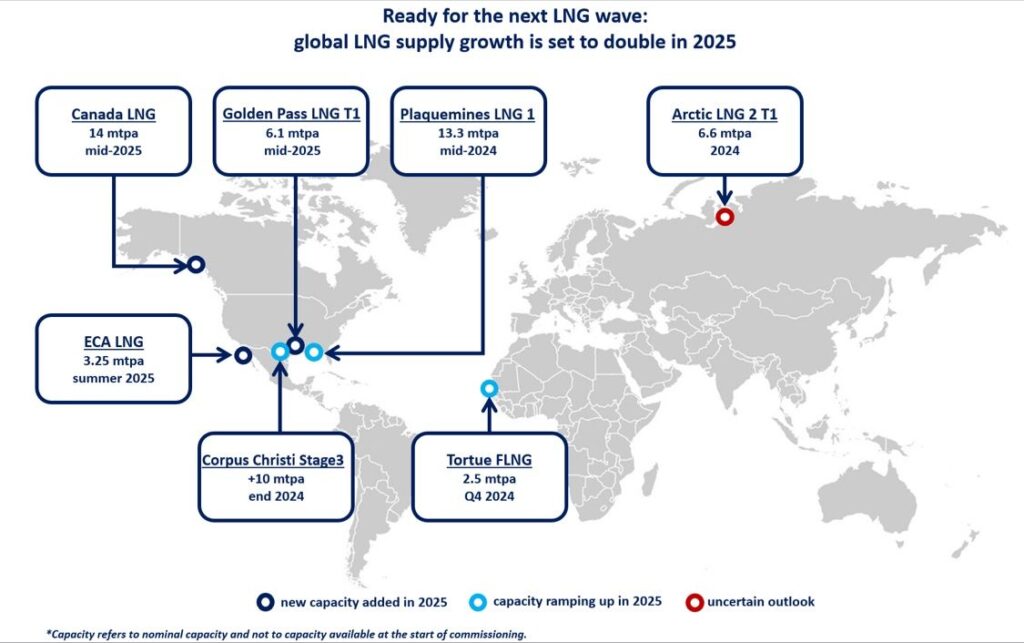

Global LNG supply growth is expected to double in 2025, marking a turning point for gas markets.

After the dry years of 2021-24, global LNG supply growth is expected to increase by 35-40 bcm in 2025 -the double of the growth experienced in the previous four years.

This strong growth is primarily driven by the ramp-up and start of four new LNG export terminals in North America, accounting for over 90% of capacity additions.

The Plaquemines LNG facility is expected to start operations already in mid-2024 and then gradually ramp-up production through 2025. the project is using small-scale modular liquefaction units, allowing for shorter lead times and a start of operations just two years after taking FID.

The Corpus Christi LNG Stage 3 expansion, also relying on a modular design, is set to start operations towards the end of 2024 and ramp-up LNG deliveries over 2025.

LNG Canada and Golden Pass LNG Train 1 are expected to start deliveries by mid-2025. in addition, Altamira FLNG and ECA LNG in Mexico are expected to ramp-up production in 2025, relying on US LNG feedgas deliveries.

Outside of North America, there will be limited LNG capacity additions in 2025. the heavily delayed Tortue FLNG is expected to start operations in Q4 2024, offshore Mauritania and Senegal.

Last but not least, sanctions casts a long shadow on Russia’s Arctic LNG 2 project, which started producing LNG already in December 2023 but still no LNG deliveries, primarily due to shipping constraints.

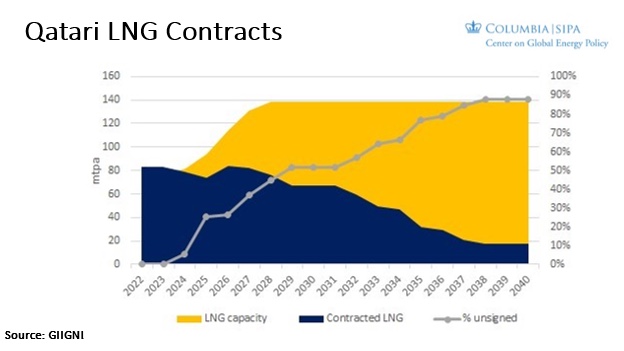

The strong LNG capacity additions pave the way for a new golden phase for LNG, which will be reinforced by start-up of Qatar’s North Field East expansion project in 2026.

Source: Greg Molnar