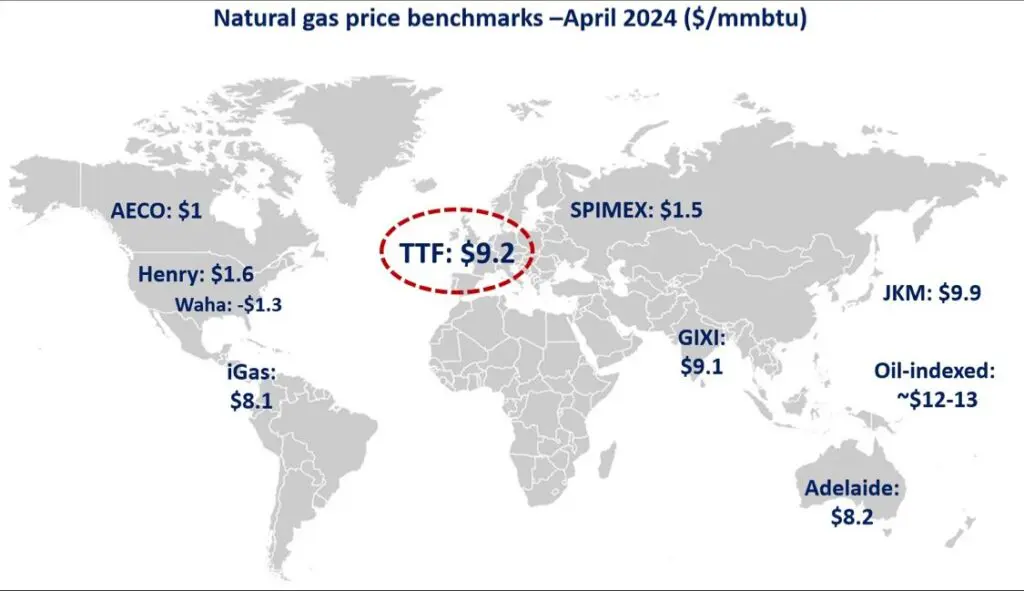

Gas prices in North America remained at multi-decades lows in April, while European and Asian spot prices strengthened amidst geopolitical tensions and outages.

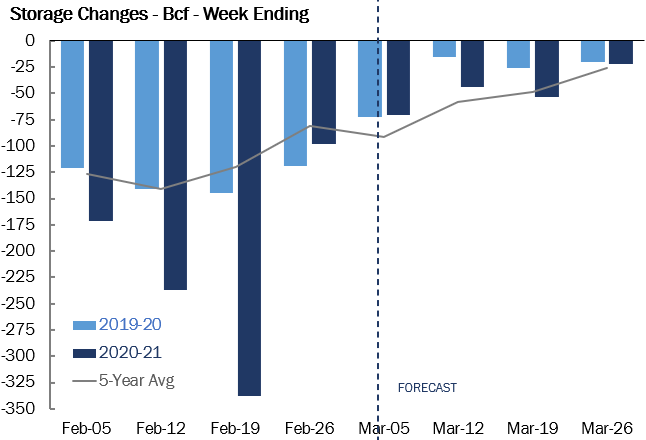

In the US, Henry Hub prices fell by 25% yoy to an average of $1.6/mmbtu -their lowest April average since 1995. high storage levels (37% above 5y average), together with lower LNG exports put downward pressure on prices despite lower domestic production (-1.5%) and higher gas burn in the power sector (up by 6% yoy).

In the Permian, Waha gas prices collapsed to an average of -$1.3/mmbtu -their lowest monthly average on record. strong associated gas production, pipeline outages, lower LNG feedgas demand and high storage levels all pushed down Permian gas prices into negative territory.

In Canada, AECO dropped by 45% yoy to an average of just $1/mmbtu. high storage levels, together with subdued demand and lower piped gas exports to the US pushed down Canadian prices.

In contrast, gas prices in gas-starved Colombia rose by 30% yoy to $8.1/mmbtu as low hydro availability is driving up gas-fired generation to record highs.

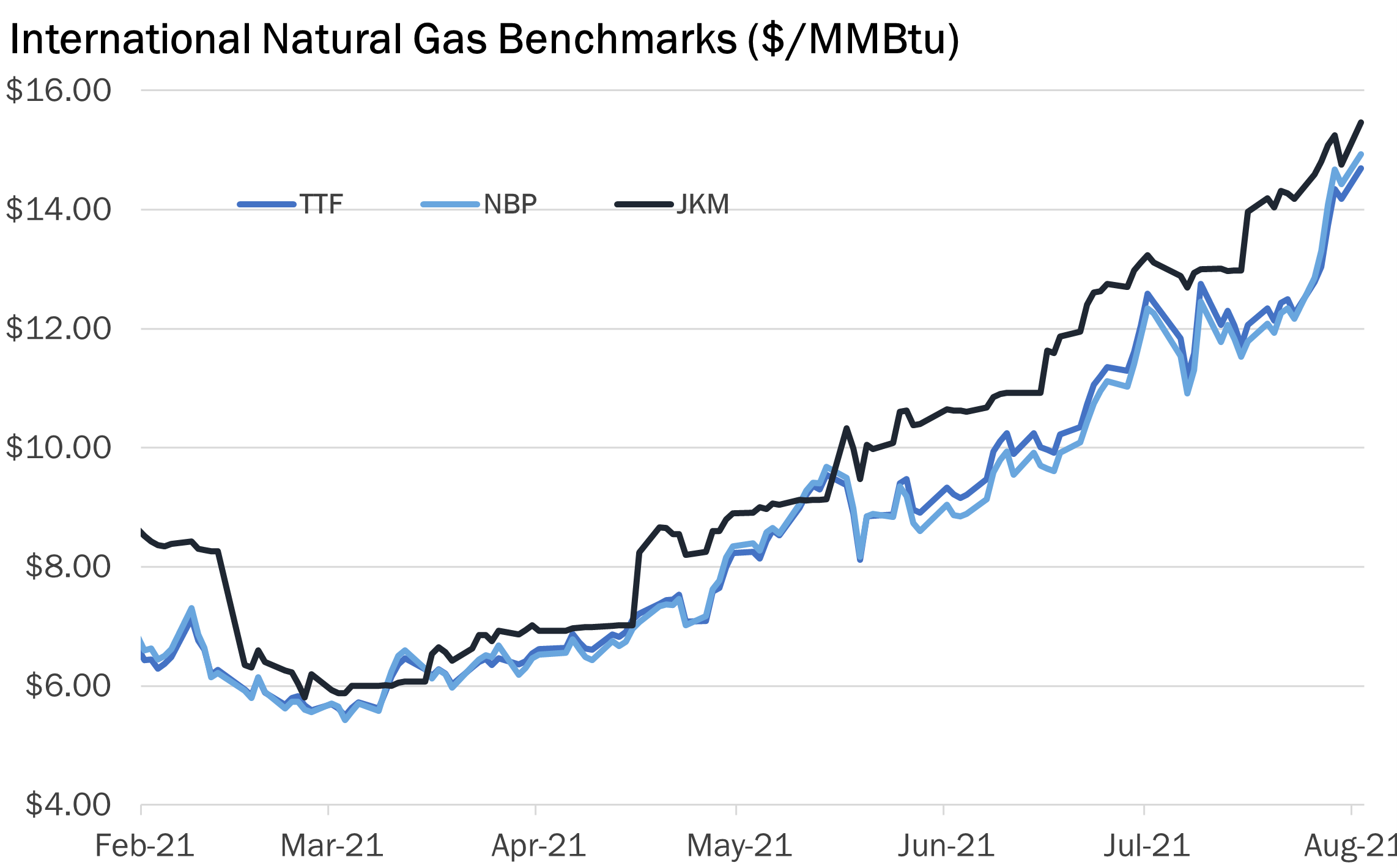

In Europe, TTF gained 8% month-on-month and averaged at just above $9/mmbtu. geopolitical tensions together with outage in Norway and at US LNG facilities provided upward pressure on gas prices, despite a continued decline in demand and very high storage levels.

In Asia, JKM prices followed a similar trajectory and rose by 10% mom to near $10/mmbtu -although remaining at a $2-3/mmbtu discount compared to oil-indexed prices. China is back at full strength, with the country’s LNG imports up by 30% yoy.

Source: Greg Molnar