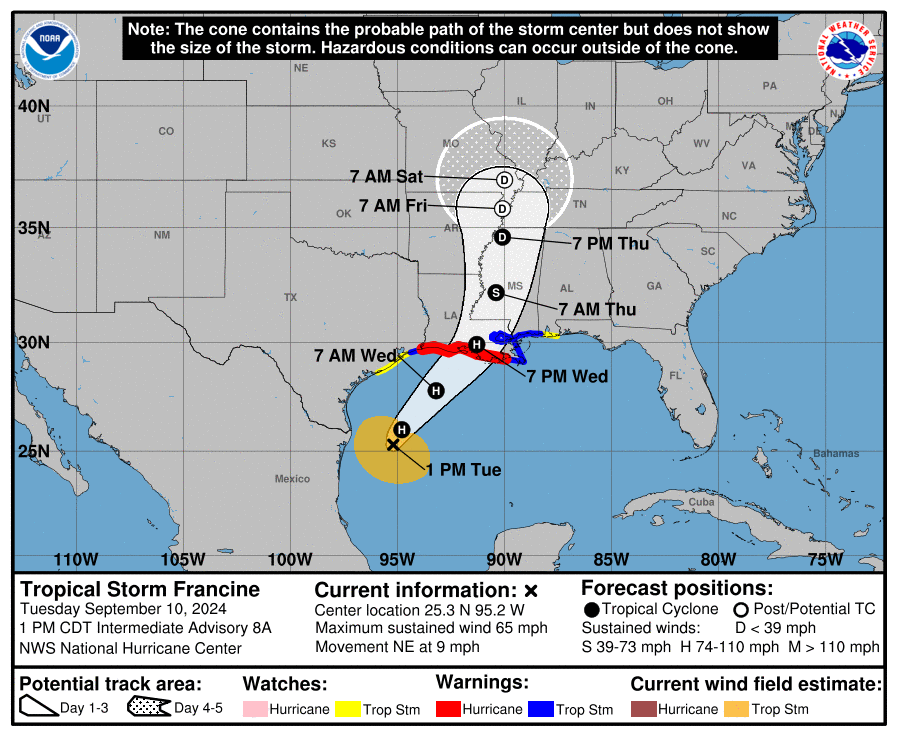

The natural gas market remains focused on Tropical Storm Francine, which is expected to intensify today and potentially become the fourth hurricane of the Atlantic season.

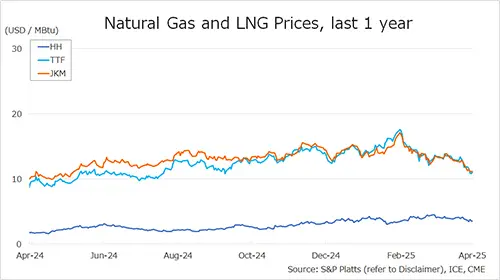

The natural gas front-month contract is currently up 6 cents, trading at $2.23/MMBtu, driven by early speculation.

Despite this, the overall market sentiment is bearish due to the storm’s projected path and potential effects. Production declined by 2.35 Bcf/d today, mainly in the Southeast and Southwest regions.

However, most natural gas production comes from inland shale basins that are well outside the hurricane’s expected path, reducing the likelihood of significant supply disruptions.

On the demand side, if the hurricane makes landfall, it could lead to cooler temperatures, power outages, and disruptions at LNG export facilities along the Gulf Coast, all of which may dampen demand.

Although October and November contracts have seen upticks reflecting market caution, the prevailing expectation is that the storm’s impact will be predominantly bearish, particularly if substantial disruptions occur.

Source: Gelber & Associates