Strikes at each LNG import terminal in France reduced terminal availability and imports have slowed in March. Strikes at two terminals at the port of Marseille-Fos and one terminal at the port of Montoir are ongoing at the time of writing, but the Dunkirk terminal operated by Fluxys in northern France has resumed operations after a brief strike.

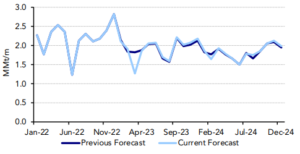

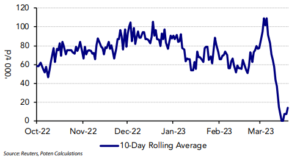

Negotiations between parties are still ongoing and it’s unknown when all terminals will be back to full capacity. The impact of the strikes on LNG imports is given in the top graph. The graph shows the 10-day rolling average for LNG imports in France.

Prior to the strikes in early March, the 10-day rolling average hit its highest point since December 2022 but fell to zero by the middle of the month when the strikes began.

France 10-day Rolling Average of LNG Imports

The strikes are of interest to the LNG market because France was the largest LNG importer in 2022 to Europe, pulling in about 20% of the region’s total imports last year.

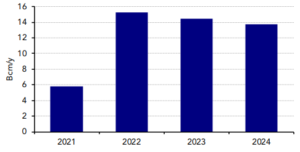

Much of the LNG was regasified and exported to other countries, facilitating greater energy security and growth in European inventories. French pipeline exports grew to 15.2 Bcm in 2022 from 5.8 Bcm in 2021.

Pipeline exports are forecast to fall slightly in 2023 to 14.5 Bcm due to the decline in LNG imports and a lower sense of urgency in the rest of Europe to refill storage levels compared to last year. Pipeline exports are forecast to continue falling in 2024 to 13.8 Bcm.

France Pipeline Gas Exports

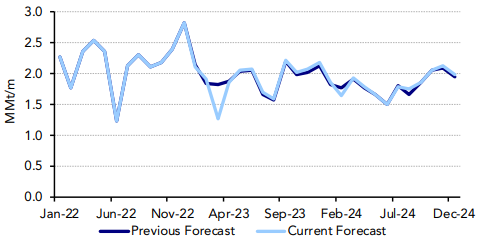

The import forecast has been adjusted lower for March 2023 from 1.8 MMt in the previous forecast to 1.3 MMt in the current forecast. Imports are forecast to increase to 1.9 MMt in April 2023 on the assumption that all parties reach an agreement in the strikes.

Additionally, France will need to ramp up LNG imports to replenish inventory levels amid lower nuclear output. Current inventory levels for France are around 3.7 Bcm or 30% full, and nuclear output is around 50 GW or at 80% of capacity.

LNG imports are forecast to fall to 23 MMt in 2023 and 22 MMt in 2024 from 26.5 MMt in 2022.

France LNG Import Forecast Comparison