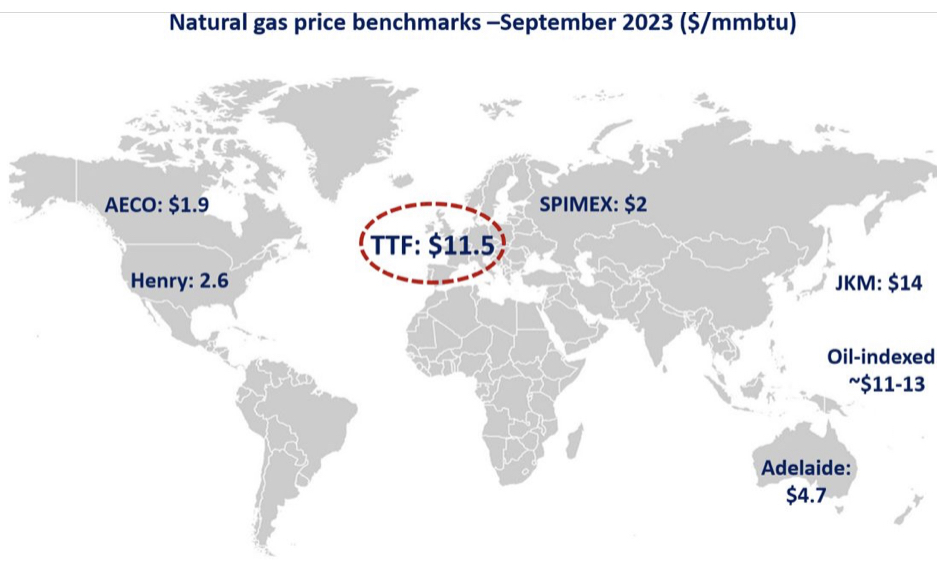

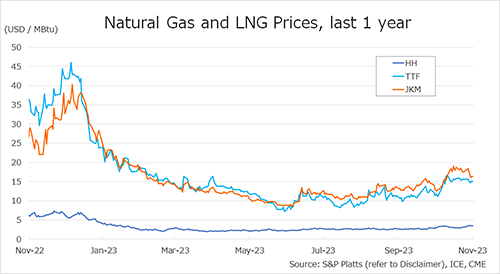

The Northeast Asian assessed spot LNG price JKM for the previous week (30 October – 3 November) was in the low USD 16s on 3 November, after firming from the high USD 17s the previous week, and then falling due to bearish market sentiment and healthy inventory levels.

METI announced on 1 November that Japan’s LNG inventories for power generation totaled 2.18 million tonnes as of 29 October, down 0.03 million tonnes from the previous week, down 0.35 million tonnes from the end of the same month last year, and up 0.17 million tonnes from the average over the past five years.

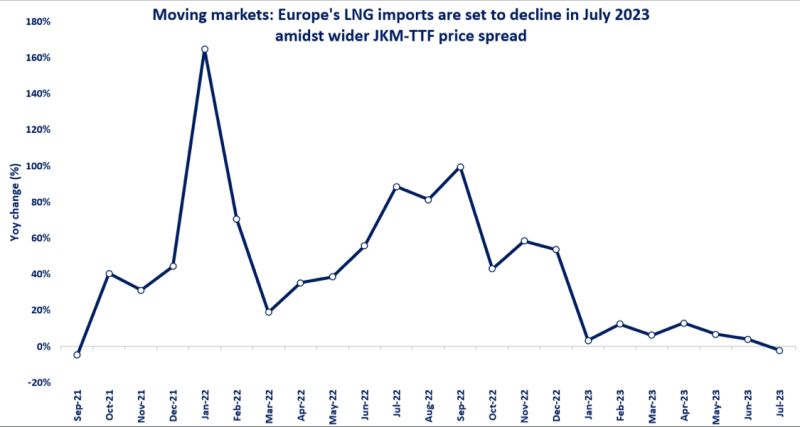

The European gas price TTF was USD 15.1/MBtu on 3 November from USD 15.6/MBtu the previous week.

European gas prices were supported by the situation in the Middle East and the expected deterioration in weather conditions, while risk factors such as the Australian strike and the Baltic Connector pipeline were decreasing.

According to AGSI+, the European underground gas storage rate as of 3 November was 99.5%, up from 98.8% the previous week.

The U.S. gas price HH was USD 3.5/MBtu on 3 November from USD 3.2/MBtu the previous week on the back of expectations of steady demand.

According to the EIA Weekly Natural Gas Storage Report released on 2 November, the U.S. natural gas underground storage on 27 October was 3,779 Bcf, up 79 Bcf from the previous week, up 8.4% from the same period last year, and up 5.7% from the average of the past five years.

Updated: Novober 06

Source: JOGMEC