NYMEX prompt month natural gas futures have begun a bounce after breaking through $2.00/MMBtu support during after-hours trading last night.

The last time natural gas prompt month futures were below $2.00/MMBtu was almost 2.5 years ago on September 24, 2020.

Price has rebounded by 12 cents since yesterday’s settle of $2.07/MMBtu, and indicators are showing technical momentum to the upside in the short term.

Traders appear to be targeting the $2.00/MMBtu price level as a key support level for the market in anticipation of the storage report tomorrow.

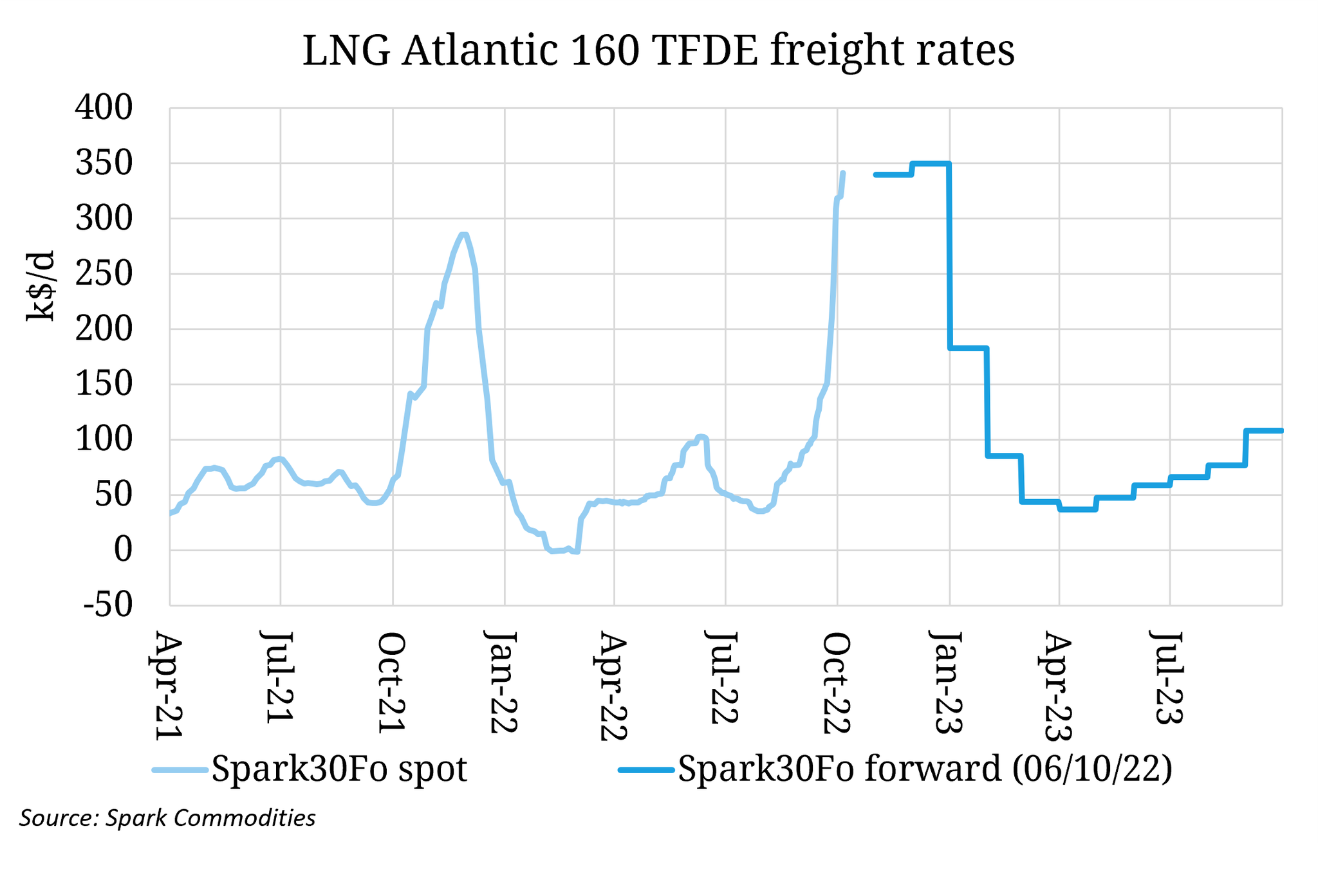

Freeport LNG announced yesterday evening that it has finally received regulatory approval to commence commercial operations of the company’s natural gas liquefaction and export facility.

This allows the full restart of one train immediately and the incremental restart of a second train.

A third train will require more regulatory approval as it achieves operational conditions.

The market has anticipated this announcement following a docking at the LNG facility on February 10th. Going forward, Freeport is anticipated to withdraw 2 Bcf/D from the US gas supply.

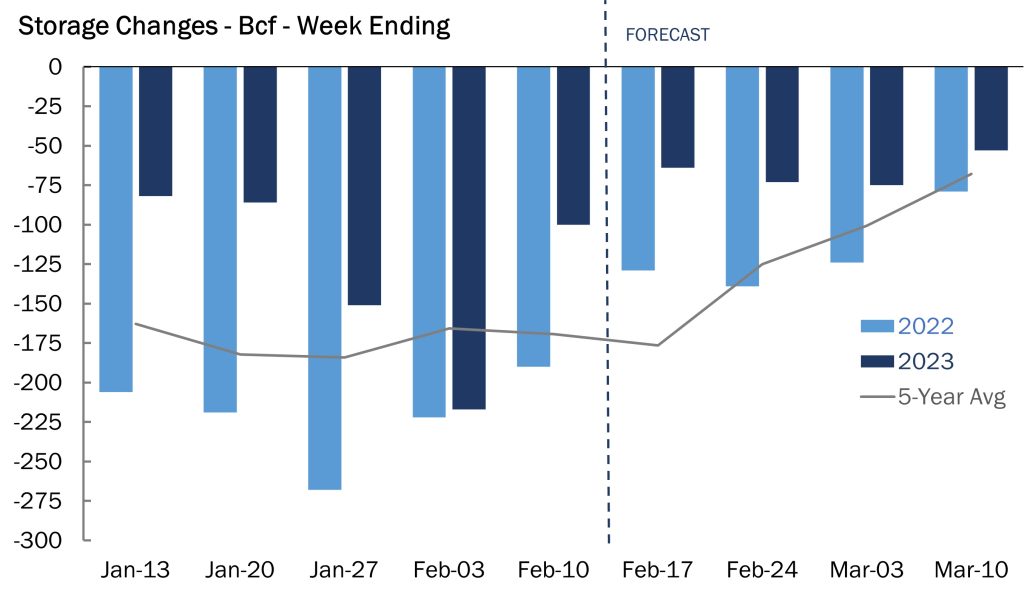

The fundamentals have supported a low storage withdrawal for the week ending February 17th.

An oversupplied market due to record production despite the low-priced environment in conjunction with a warm week over the lower 48 reducing ResComm demand points to a low storage withdrawal.

Fuel switching away from gas to wind and solar has been on the higher end for the storage week.

Now that Freeport LNG has gotten FERC approval, LNG demand will begin to take gas out of the market which may somewhat normalize the low withdrawals that have been seen thus far in 2023.

G&A anticipates a 64 Bcf withdrawal from working storage for the week ending February 17th.

source: Gelber and Associates