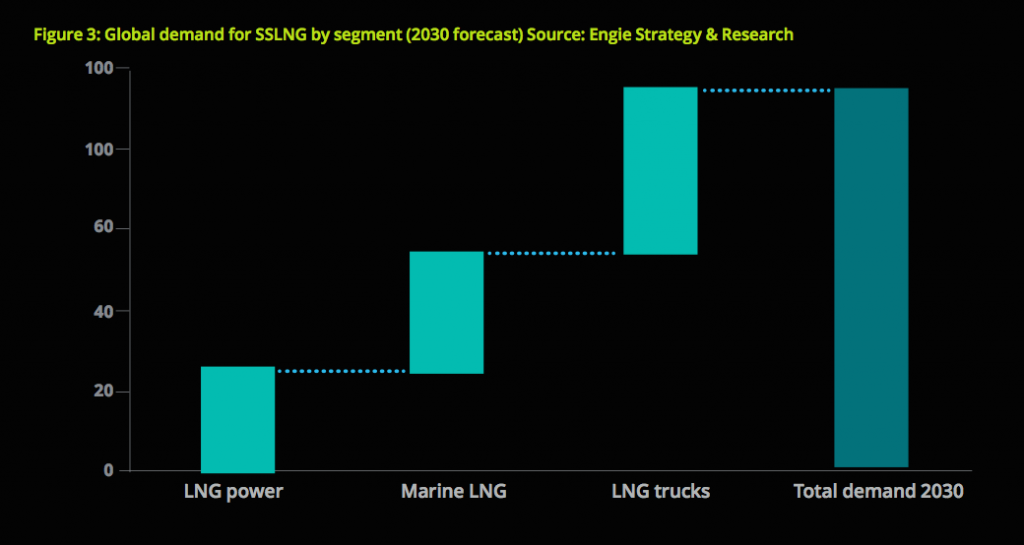

Applications of SSLNG are currently in three major end uses: marine fuel (bunkering), fuel for heavy road (and rail) transport, and power generation in off-grid locations. As technology enables more flexible supply, other markets will emerge.

Opportunities for SSLNG are particularly prevalent in markets where other forms of energy are expensive, unavailable or unreliable. Even in energy markets where competition is high, SSLNG can compete due to low energy unit costs and flexibility. Growth projections for the SSLNG market are high, with the IGU predicting a global demand for SSLNG of 30 million tons this year.

Meeting regional energy needs can now be done in a flexible and agile way using SSLNG

Demands are expected to increase with estimates of be between 75 and 95 million tons by 2030, with 26% in power, 32% in marine bunkering and 42% in fuel for heavy road transportation.

Furthermore, the global SSLNG market accounted for USD 29.31 billion in 2018 and is expected to reach an estimated value of USD 49.66 billion by 2026, growing at a compound annual growth rate (CAGR) of 6.81% during the forecast period of 2019-2026.

The risk of participating in the SSLNG industry is reduced because the underlying gas processing technology is similar to that of conventional large scale LNG.

The risk for building out SSLNG infrastructure can be reduced by leveraging large scale LNG technology and techniques. Specific attention needs to be given to the cryogenic materials required to handle LNG.

Both the design of and fabrication techniques using specialised materials are not always available and the cost of these skills can be significant due to their scarce nature. Recently, modularised designs have allowed the development cost to be reduced and speeds up project development.

Southern African Region

In the Southern African region, SSLNG provides a great opportunity in the electricity and energy sectors, due to the challenges faced with securing reliable electricity supply from state- owned utilities.

In the Southern African region, SSLNG provides a great opportunity in the electricity and energy sectors, due to the challenges faced with securing reliable electricity supply from state-owned utilities. Users can use SSLNG as an alternative to diesel generation. Even the best state-sponsored utility power build out can takes years to deliver, even without delays, and this is especially true in remote and rural areas.

Meeting regional energy needs can now be done in a flexible and agile way using SSLNG. With mega-LNG projects under development in Mozambique, regional LNG and natural gas supply will be increasing rapidly, and the price point will be favourable to many end users, presenting opportunities to change the energy mix in Southern Africa at all points in the potential SSLNG supply chain.

Source: Deloitte