Following a week that was once again chock full of daily price volatility, NYMEX front-month natural gas futures finished in negative territory ahead of the weekend as sellers scrambled for the exits.

Interestingly enough, the bearish sentiment was derived from some fictitious information circulating in the market regarding an alleged ‘delayed restart’ of the Freeport LNG export terminal. After surging more than 37 cents on Thursday following a bullish weekly gas storage report, NYMEX December 2022 gas futures shed 36 cents (or nearly 6%) to close at $5.879/MMBtu on November 11 and finished down 8% for the week.

On Friday, NYMEX front-month gas futures rallied to a high of $6.505/MMBtu before rumors (via fake Twitter tweets) started being re-tweeded by some large speculative players (hedge fund managers) in the gas market.

The false news suggested that the Freeport LNG export facility was dealing with cracked pipes and would not return to service until at least January, if not later.

This information (albeit false info) quickly spread through the market, causing NYMEX gas futures prices to plummet to an intraday low of $5.775/MMBtu.

Following the fictitious information, later that day, there was yet another lie that rapidly spread through the market stating that the Freeport LNG terminal denied the delayed restart rumor and was on pace for a November reopening of the facility. However, this turned out to be a fake rebuttal by Freeport.

Eventually, the company finally released an ‘official statement’ that denied the rumors perpetrated on the market, but the Freeport LNG facility market management also did not announce a return to service date in their statement.

Nonetheless, many gas market players were furious about how the false information created such exaggerated volatility in prices and turned a bullish move in prices into a hefty sell-off. Some market participants suggested that the Commodity Futures Trading Commission (CFTC) should look into the situation and launch an investigation to seek out the origin of the false information that appeared to be purposefully planned to instigate a sell-off in gas futures prices.

As of today, NYMEX front-month gas futures are back in positive territory, trading as high as $6.416/MMBtu, which stems from the near-term temperature outlook that has trended colder for at least the next 7 days, ushering in Polar-chilled air into the central and eastern regions of the US. In fact, the current period will be the coldest week in mid-November since 2018. However, after November 22, the major weather forecast models show that temperatures may be poised to moderate back toward seasonally average conditions with forecast gas-weighted degree days (GWDDs) returning to normal for the last week of the month.

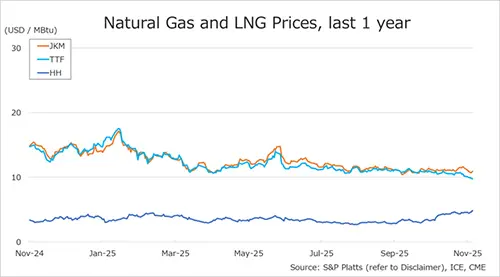

Over the weekend, dry gas production volumes continued to oscillate between 99 Bcf/d and 100 Bcf/d, while LNG feedgas volumes rose to 12.5 Bcf/d, which is up more than 1 Bcf/d on a year-over-year basis. The increase was influenced by Cove Point, Sabine Pass, Cameron, and Corpus Christi all operating at around 95% capacity.

Once the Freeport LNG facility legitimately returns to service, it will lift LNG feedgas exports up to new highs of just under 15 Bcf/d.

With several bullish drivers currently in play, namely below-average temperatures, it’s likely that NYMEX front-month gas futures may attempt to test the $6.50s/MMBtu to $6.80s/MMBtu in the relatively near term. On the downside, technical support is seen at $5.98/MMBtu, followed by $5.775/MMBtu. If there are at least two closes below the latter, it would set the stage for a further move down to the $5.40s/MMBtu.

Source: Gelber & Associates