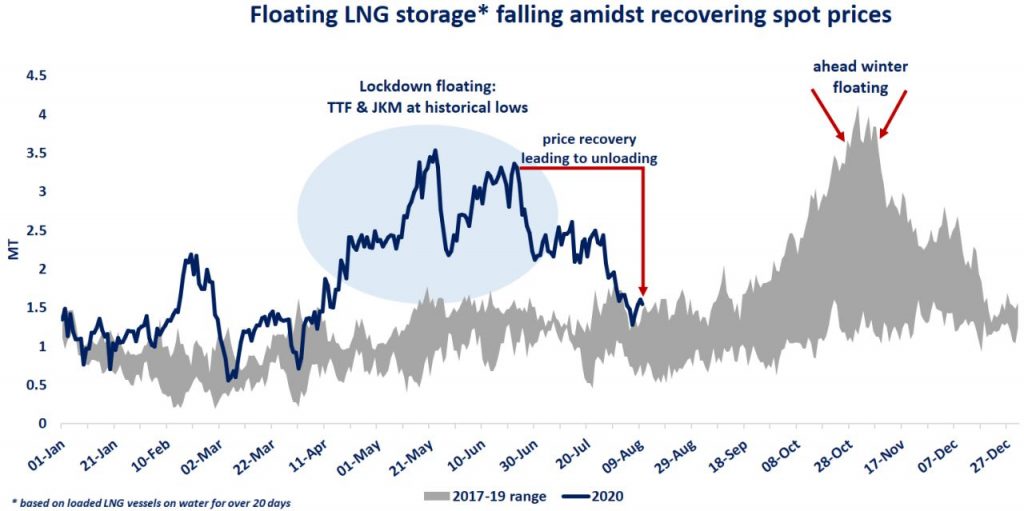

(Greg Molnár) Floating LNG storage more than halved since mid-June, amidst recovering Asian and European spot prices and cargo cancellations from the US.

LNG floating played a key role during the lockdowns, when both TTF and JKM plummeted to historical lows and some market players preferred to hold their cargoes on water, waiting for prices to recover.

Since mid-June both TTF and Asian spot prices picked up, both gaining well over 50% amidst recovering demand and tightening supply (with over 120 US LNG cargoes cancelled for summer deliveries).

This in turn resulted in a rapid sell-off of floating LNG cargoes, with floated volumes now the lowest since beginning of April and close to their historical range.

But could we see a second build-up of floating storage amidst the heating season?

This is something we have seen through the last two Gas Years and current forward spreads could provide some incentive again, with JKM Oct-20 trading $1/mmbtu above the September contract… and floating costs $0.3-0.5/mmbtu at current charter rates.

What is your view? Could we see more floating this year ahead of winter? Or the market is still too loose? What would it mean for charter rates?

Follow & connect with Greg Molnar on LinkedIn