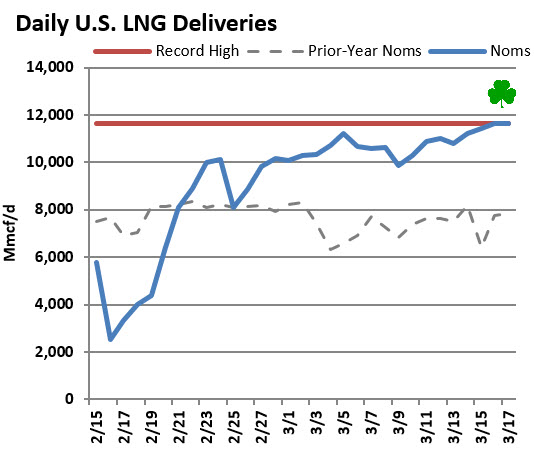

Yesterday afternoon, the front-month surged quickly to $6.39, before closing the day at $6.31, blowing past the previous rally high of $6.28. Price action yesterday was extremely similar to those in international markets, where European benchmarks like the Dutch TTF soared to over $39.

As a result, the November contracts daily settle yesterday is now cited as the highest daily close of a natural gas contract since 2008, when natural gas reached a peak of $13.58/MMBtu in mid-July.

Price action today has been nearly the opposite of that of yesterday. Despite the front-month soaring to heights of $6.466 in the early morning, prices would very quickly start reversing into a downtrend.

Focus in the market has momentarily shifted back to domestic metrics, and as a result of early expectations for a bearish storage report, the front month is currently trading at $5.88, nearly 40 cents below yesterday’s close.

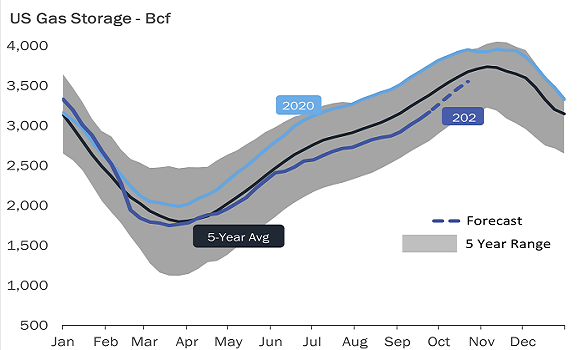

G&A estimates that this week’s injection will amount to 101 Bcf, exactly 20 Bcf above the five-year average injection for this time of year. Low weather-driven demand coupled with slightly higher week-over-week production has given way to potential for a triple-digit injection.

While triple-digit injections aren’t exactly unheard of for this time of year, they are somewhat rare. In the past, out of the last 26 years, only three have yielded 100+ injections for this particular week of storage.

G&A also senses potential for additional triple-digit injections in the next two weeks – a testament to the sizeable lack of weather-driven demand in the current market.

The materialization of these higher-than-average injections will pull 2021 storage closer to the five-year average, as displayed below.

Source: Gelber & Associates