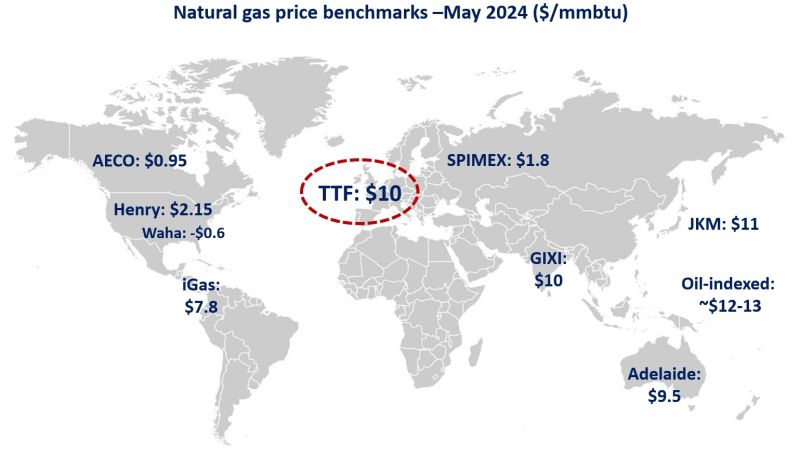

Tighter fundamentals and geopolitical uncertainties strengthened gas prices across all key markets in May.

In the US, Henry Hub prices surged by more than 30% compared to April to an average of $2.15/mmbtu. productions cuts (-3% yoy), together with a continued strong increase in gas-fired generation (up by 5.5%) provided upward pressure on prices.

And while $2.2/mmbtu is certainly a relief compared to the price slump through Feb-Apr, we are still below the average production cost of most US upstreamers.

In Europe, TTF prices rose by 10% month-on-month to average at $10/mmbtu. while storage levels remain well-above their 5y average, lower LNG inflows together with Norwegian outages and renewed risks around Russian piped gas supplies all supported higher gas prices.

The notice from Austria’s OMV is a stark reminder that the saga with Russian gas is set to continue and could fuel price volatility over the summer.

In Asia, JKM prices followed suite and strengthened by around 10% to $11/mmbtu -hence, approaching the lower end of oil-indexed LNG contracts.

China’s growing LNG appetite (up by 25% yoy), heatwaves in India and unplanned outages in Australia (Gorgon) are all supporting higher spot LNG prices.

Source: Greg Molnar