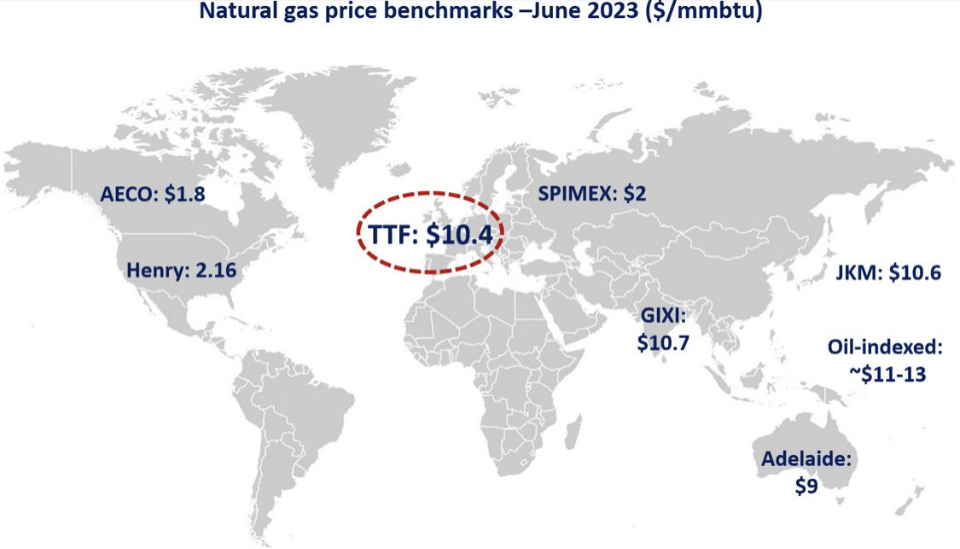

Natural gas prices remained broadly stable in June, and steeply down compared to last year’s summer highs, as improving market fundamentals continue to put downward pressure on key benchmarks.

In Europe, TTF month-ahead prices were down by 70% yoy, averaging at just above $10/mmbtu. High storage levels (78%), steep demand decline (-14% yoy) and healthy LNG inflow (up by 12% into the EU) weighed on gas prices.

This is despite the steep reduction in Russian piped gas and heavy maintenance/unplanned outages in Norway.

In Asia, JKM prices followed a similar trajectory, being down by over 60% to an average of $10.6/mmbtu.

While China’s demande returned to a clear growth pattern, demand reductions in Japan and Korea are moderating down price pressures.

In the US, Henry Hub prices stayed close to their May levels and down by 70% yoy to an average of $2.16/mmbtu.

While demand stayed close to last year’s levels, strong production growth coupled with high storage levels (15% above 5y average) continue to depress the US benchmark.

What is your view? How will prices evolve through the rest of the summer?

As EU storages are getting full, injection rates are slowing down, further weighing on demand. This could potentially further ease up market fundamentals… unless some geopolitical or technical surprises.

Source: Greg MOLNAR