Pakistan has an LNG import infrastructure with capability of handling thirteen vessels per month with load size ranging from 143,000 CBM to 165,000 CBM. If we assume 92% utilization of terminal capacity with almost 35 days for maintenance per year, Pakistan can import approximately twelve vessels per month.

Pakistan’s two LNG terminals have the storage capacity of approximately 140,000 tons of LNG and regasification capacity of 1.35 BCFD, out of which 1.2 BCFD is contracted to South Southern Gas Company (SSGC). During the first eight months of 2018, total of 74 vessels arrived, 49 vessels at Engro Elengy Terminal Limited (ETPL) & 25 vessels at Pakistan GasPort Limited (PGPL). That translates into approximately six vessels per month for ETPL and three vessels for PGPL, with ETPL operating at 100% whereas PGPL operating at approximately 47% of design and 52% of contracted capacity.

There are two state owned buyers responsible for LNG procurement and two distribution companies with pipeline network of transferring 1.2 BCFD of RLNG/Natural Gas from Southern Pakistan to Northern Pakistan.

The under utilization of second terminal in a country where there is a shortfall of 4 BCFD of natural gas requires a strategy with focus on:

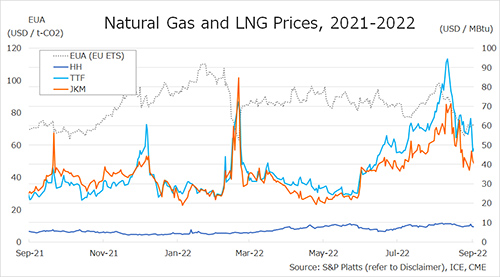

LNG is being imported currently into Pakistan on long-term contract basis pegged on slope of Brent crude oil marker, with few on fixed price/formula basis. Pakistan needs to take advantage of its LNG buying appetite and secure some volume on Henry Hub based price which has been cheapest source for Asian market and current crude oil trend suggests that Henry Hub based pricing will remain cost effective. In this regard Pakistan needs to secure some volumes directly from new LNG liquefaction projects, which are still not in final investment decision (FID) stage.

Pakistan also need to reschedule its already contracted LNG procurement so that all the contractual volumes reach the terminals as per maximum RLNG send out rate so that there is capacity available in the terminal and pipeline for other importers to import and distribute RLNG in the network. Example is run the second terminal at 750 MMSCFD so that in first thirteen and half days all three cargoes are imported or six cargoes to be brought in in twenty seven days, so that there is 4 days left to bring in a 143,000 CBM vessel by private importers.

Regarding CNG sector, maximize RLNG send out rate and, sell the unutilized terminal and pipeline capacity to CNG sector companies to import and distribute the RLNG to CNG retailers. Government should let CNG sector to import LNG and sell CNG based upon their procured price without state responsibility to supply them natural gas. This will help better utilization of existing terminal and revival of CNG sector, as importing and reselling to CNG sector by state owned companies has resulted in reduced margins for retailers.

There should be a policy where the power generation should be done based upon imported LNG and power supply infrastructure from North to South should be used for exporting power from South to North. Currently 650 MW power being supplied from North to South versus exporting same will ease up at least 100 MMSCFD of pipeline capacity, along with creating demand for 200 MMSFCD at the port city by setting up 1,300 MW power generation unit.

LNG import policy should be derived where utility buyers to develop their own LNG import hedging strategies as being done by all utility buyers around the globe. There is definitely a requirement for another terminal where economies of scale can be attained through utilization of existing terminal service providers, as they can enhance their capacities more effectively then a new entrant.

These are my personal views and doesn’t intent to criticize any entity for their performance rather than focusing on improvement of LNG supply in a more effective manner.

Source: Kaleem Asghar