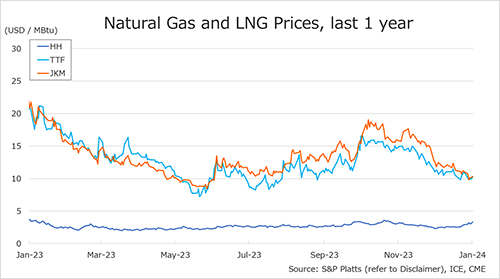

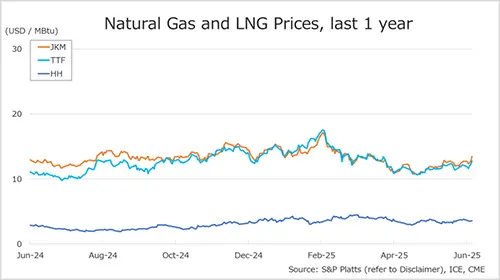

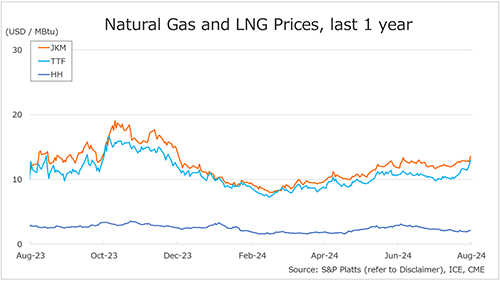

The Northeast Asian assessed spot LNG price JKM for last week (5 – 9 August) rose to mid-USD 13s on 8 August from high-USD 12s the previous weekend (2 August), the highest since December 2023(No JKM data due to Singapore National Day on 9 August).

For the first half of the week, there was a lack of buying interest in East Asia and modest price movements, but the JKM rose sharply on the back of heightened geopolitical risks following the 7 August attack of Russia’s Kursk region by Ukrainian troops.

METI announced on 7 August that Japan’s LNG inventories for power generation as of 4 August stood at 1.92 million tonnes, down 0.22 million tonnes from the previous week.

The European gas price TTF for last week (5 – 9 August) rose to USD 12.9/MBtu on 9 August from USD 11.6/MBtu the previous weekend (2 August).

Despite stable supply from Norway, TTF rose by more than one USD/MBtu from the previous weekend due to heightened tensions in the Middle East, as well as increased geopolitical risks from the Ukrainian military’s attack on Russia’s Kursk region. According to AGSI+, the EU-wide underground gas storage increased to 87.1% as of 9 August from 85.5% the previous weekend.

The U.S. gas price HH for last week (5 – 9 August) rose slightly to USD 2.1/MBtu on 9 August from USD 2.0/MBtu the previous weekend (2 August).

The EIA Weekly Natural Gas Storage Report released on 8 August showed U.S. natural gas inventories as of 2 August at 3,270 Bcf, up 21 Bcf from the previous week, up 8.2% from the same period last year, and 14.9% increase over the five-year average.

Updated: August 13

Source: JOGMEC