US LNG projects were already high on the list of new capacity being prepared for final investment decisions (FID) in 2022-2023 and Russia’s invasion of Ukraine has reinforced their position. The tight window for buyers wanting to secure alternative energy supply to reduce reliance on Russian energy could tip the balance of power towards certain sellers.

Recent sanctions and the exit of some western companies have made it much harder to develop new liquefaction projects in Russia, while completion of the 19.8 MMt/y Arctic LNG 2 project risks being delayed. If sanctions are ratcheted up and international contractors withdraw their services, it is likely that Train 1 of the three-train project would still be built because much of the equipment it needs is already in Russia. While the outlook is more blurred for Trains 2 and 3, it is in Novatek’s favor that the modules are coming from China, which has not joined the rounds of sanctions imposed by the US, EU, and others

There is a perceived “war” risk premium even for non-Russian volumes that would be available from 2025. However, Venture Global’s low-price strategy for 20-year contracts captured most of the US LNG sales and purchase agreements (SPA) signed in the last five years, and several other US projects were put on hold or delayed as they could not compete against sub-$2/MMBtu fixed fees.

Buyers tend to rank projects with existing Federal Energy and Regulatory Commission (FERC) approvals, engineering, procurement, and construction (EPC) agreements, and sufficient offtake agreements higher on their wish list. The recent backtracking on greenhouse gas emissions policies for natural gas infrastructure by the FERC after industry feedback removes policy uncertainty for new export capacities.

However, most US projects are marketing volumes at price offers close to pre-invasion levels, to sell the tons quickly and get closer to FID, based on price discussions heard in the last month. This is because there are many competitors – there is a long pipeline of fully permitted projects. Even if they could achieve FID this year, they would produce their first LNG from 2026-2027 onwards.

Politics aside, US LNG supply has increasingly become more valuable to buyers also because of rising market volatility and high Brent prices. Therefore, there has been a bigger push to secure more US LNG volumes, as Henry Hub is perceived as a stable price benchmark and adds price diversification to a supply portfolio.

The US has pledged to work with global partners to supply an additional 15 Bcm (11 MMt) of LNG to the EU this year, as both sides look to shore up Europe’s energy and gas supply security. The EU will also work to offtake an extra 50 Bcm/y of US LNG from now to 2030. It is also possible that European buyers could form a buyers’ consortium to negotiate long-term deals with US projects.

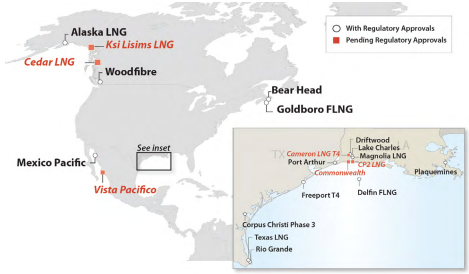

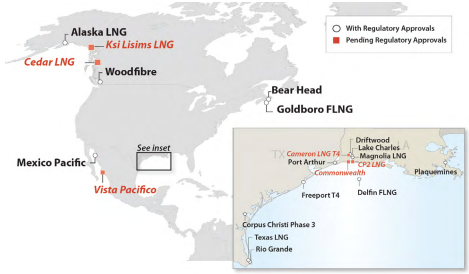

US Project Status

Venture Global keeps marketing strategy

Venture Global has nearly sold-out supply from its second project, 20-MMt/y Plaquemines LNG. It has at least 15 MMt/y of 20-year SPAs to underpin its pre-FID in Plaquemines LNG and recently started bundling the remaining volumes with offtake from its proposed 20-MMt/y CP2 LNG. As the FID gets closer for Plaquemines LNG, further supply on top of the 15 MMt/y already sold could be considered bridging volumes for CP2 LNG. Buyers would need to sign at least 1 MMt/y from CP2 LNG to secure the bridging volume.

This strategy echoes the way Venture Global signed up buyers for Plaquemines LNG. The company offered bridging volumes from its first project, Calcasieu Pass LNG, along with Plaquemines LNG volumes, as a sweetener for buyers to get Plaquemines LNG across the finish line. Supplies from Calcasieu Pass are firm volumes and attractive for buyers since they reduce FID supply risk for Plaquemines LNG. China’s Sinopec is getting four cargoes from Calcasieu Pass this year as part of a three-year bridging deal for its two 20-year, 4 MMt/y SPAs with Plaquemines LNG. CNOOC is expecting Calcasieu LNG bridging volumes to start in 2023 for its 2 MMt/y SPA with Plaquemines LNG.

CP2 LNG started the regulatory approval process in December 2021 and might need another 12-18 months to complete it, which places FID in late 2023 at the earliest. Venture Global is offering 20-year offtake from CP2 LNG at a low price that would have continued to prevent the development of other US projects had European demand to replace Russian gas supply not changed market dynamics.

Some projects have been making offers to buyers at similarly low levels and they include NextDecade’s Rio Grande LNG and Energy Transfer’s Lake Charles LNG. Sempra Infrastructure’s Cameron LNG Train 4 may also be able to market supply at similar levels as an expansion of a project currently in operation.

Venture Global, NextDecade and Energy Transfer’s Lake Charles LNG announced firm 20-year offtake agreements in March that were negotiated before Russia’s Feb. 24 invasion of Ukraine. They reflect the competitive, low-price strategy introduced by Venture Global.

NextDecade plans to take FID on Rio Grande LNG’s first 11.74 MMt/y two-train phase this year. Its EPC price expired in end-December, but the contract has a clause to cap future price renegotiations at a 20% increase. As Bechtel would want to keep its contract with NextDecade, rather than go through a competitive EPC bid round again, it is said that the price revision may be less than 10%. Both parties also have completed 20% of the required engineering packages, considered high for a pre-FID project, which is helping to keep the price revision down. The developer gained momentum from a 20-year agreement with a unit of Guangdong Energy Group signed in March.

Cheniere has limited volumes available depending on the start date as it has contracts that are expiring around the mid-2020s. The US Department of Energy (DOE) granted two non-free trade agreement (FTA) export permits to its Sabine Pass and Corpus Christi projects for an added 720 MMcf/d of gas to countries including all of those in Europe that do not have an FTA with the US. DOE’s approval of Cheniere’s two non-FTA permits is a quick way of increasing US LNG exports to Europe as the permits allow for the greatest amount of flexibility for both plants already operational. There may be similar permits for the other projects under discussion with the DOE, sources said.

Freeport LNG is working on Train 4, which is fully permitted by FERC. Observers say the partners will only build the expansion capacity if it meets the targeted returns and is unlikely to adopt a low-price strategy. Freeport LNG’s founder, CEO and chairman Michael Smith is seeking to offload a stake in the 15.45 MMt/y project through entities under his ownership. Although it will not come with equity offtake, interested buyers could combine the purchase with supply offtake from the proposed Train 4.

Sempra to revive Port Arthur LNG

Sempra Infrastructure is now planning liquefaction capacity additions across three projects, namely revived 13.5-MMt/y Port Arthur LNG, the Cameron LNG expansion, and the Vista Pacifico project in Mexico. Port Arthur is a fully permitted project, while Cameron LNG Train 4 and Vista Pacifico are going through the permitting process.

Port Arthur LNG had been shelved due to its prohibitive costs of construction. The project stalled after losing equity offtake when Saudi Aramco pulled out as a partner. Poland’s PGNiG later had its 2 MMt/y SPA canceled with the project and replaced the volumes in a similar deal with Plaquemines LNG. Sempra is working on cutting costs before marketing the volumes, while its EPC pricing with Bechtel stays valid. First LNG is expected by the end-2027.

Sempra had prioritized the Cameron LNG expansion after Port Arthur LNG was shelved. FERC approvals would be needed for modifications to the originally permitted two-train concept and the application was filed early this year, with approvals expected in early 2023. The capacity has been reduced to 6.5 MMt/y from 9 MMt/y, and Sempra is holding a competitive bidding process for front-end engineering design.

Source: Poten & Partners

Date: March 29, 2022