What is next for LNG contracting: Europe’s position is rapidly changing in the LNG landscape, with the EU aiming to phase-out its dependency on Russian gas and other fossil fuels before 2030.

LNG will inevitably play a key role in this diversification strategy already in the short-term.

Not surprisingly, we are seeing renewed interest in LNG regas infrastructure, including announcements from Germany, the Netherlands, Italy, Greece and list goes on.

But what about LNG contracts?

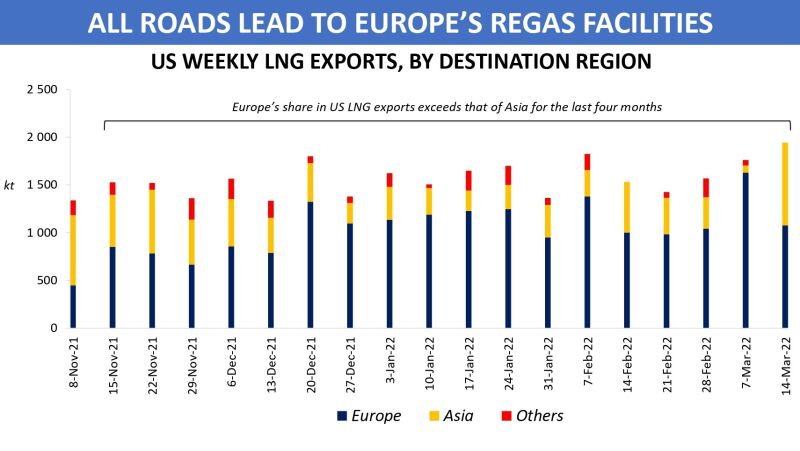

Since the beginning of 2021, about 100 bcm/y of LNG has been contracted, with 70% by Asian buyers and just 5% with destinations fixed to Europe.

About 75% of all the LNG contracted is estimated to be destination-fixed, which is increasingly valued for its security of supply benefits.

While the global LNG market has become increasingly liquid through the last decade, tighter market conditions, and stronger competition might lead to elements of contractual rigidities in the medium-term.

Looking forward to discuss today some of these topics at the European Gas and Hydrogen Conference.

What is your view? How will Europe position itself in the changing LNG landscape and could we see a change in contracting strategies?

Source: Greg Molnar (LinkedIn)