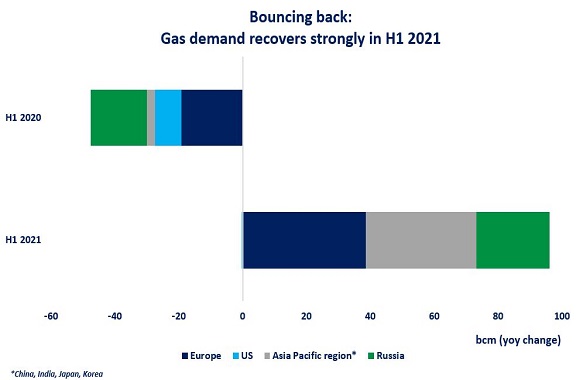

Bouncing back: after a record drop in 2020, gas demand grew strongly in H1 2021, by ~100 bcm in key gas markets, more than offsetting the losses of last year (-75 bcm).

The recovery has been largely driven by importing markets, Europe and the Asia Pacific, further contributing to the tightening of the global gas market and driving up gas prices to multi-year highs.

Growth has been particularly strong in Europe, up by close to 15% yoy as a colder and longer heating season drove up residential demand, whilst low wind, low hydro and record carbon prices supported higher gas burn in the power sector.

In the Asia Pacific region, China alone accounted for over 70% demand growth driven by strong economic recovery, mandated coal-to-gas switching and low hydro output in southeast China (-25% yoy in Guangdong). India’s gas demand remained resilient, up by 5% in the first 5M, despite the lockdown measures in April and May.

In the US, the drop in gas demand in Q1 has been almost offset by stronger growth in Q2, supported by higher gas burn in the power sector driven by strong demand growth and low hydro availability in the northwest. In Russia, gas demand was up by over 20 bcm largely supported by a colder than average Q1 and higher gas burn in the power sector.

What is your view? What is next for gas? Will the strong demand recovery continue through H2 2021? Could we see some demand response from the more price sensitive markets?

Source: Greg Molnar

See original post by Greg at LinkedIn.