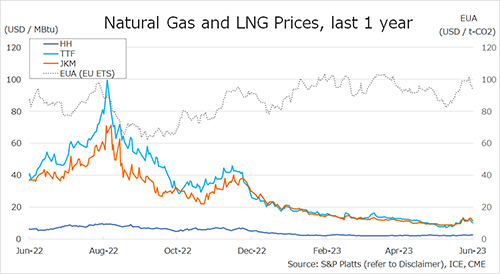

Earlier this month, news that the Freeport LNG export terminal would be coming back online in October buoyed the NYMEX front-month gas futures contract above $8.00/MMBtu before pressing even higher in subsequent days on rickety bullish excuses.

Yesterday, there was a revision to the operational date of the Freeport facility, which has now been pushed out until mid-November. This information prompted some modest weakness in prices, but the response was rather muted. At the end of trading on August 23, the NYMEX September 2022 gas futures contract fell 48.7 cents to close at $9.193/MMBtu. Today, gas futures prices are back in positive territory as buyers are apparently shrugging off the bearish news of the postponed Freeport terminal restart.

It is very interesting that a few weeks ago, the news of the Freeport terminal return in October elicited such a bullish response that lingered on for days. Shortly thereafter, a similar situation occurred when news of the Mars offshore oil and gas platform in the Gulf of Mexico was shut-in due to a leak, which sent NYMEX gas futures prices spiking over $8.50/MMBtu. However, it turned out that the shut-in of the platform lasted for less than 24 hours, yet gas futures didn’t respond in a bearish fashion and kept on climbing.

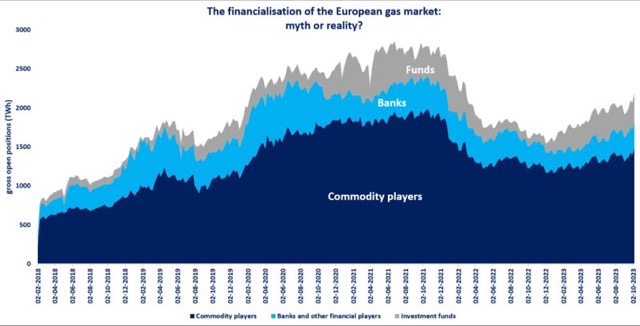

Logical thinking would suggest that yesterday’s news of the Freeport LNG export being delayed in its restart would trigger a much more bearish response in NYMEX gas futures, but since prices are being dominated by some deep-pocketed hedge funds that are massively long on futures and options, it seems that bearish news doesn’t count these days.

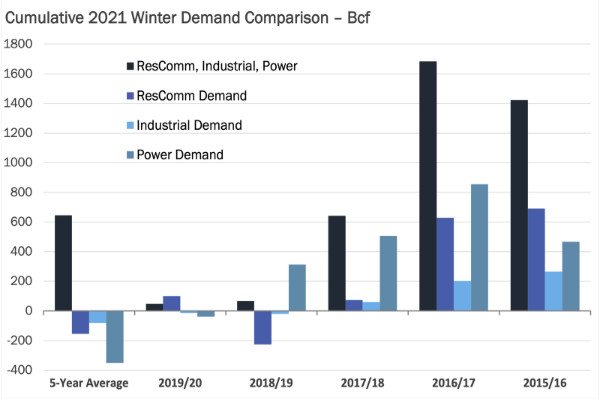

As it stands, the Freeport LNG facility won’t see volumes return until about mid-November with daily demand not likely to reach 2 Bcf/d until possibly early December. This situation will likely add about another 100 Bcf to gas storage inventories at end of the injection season. As dry gas production continues to grow beyond 98 Bcf/d and the onset of the shoulder period emerges in the weeks ahead, it’s becoming clearer that the end of the refill season is getting ever closer to reaching 3,500 Bcf, which is a comfortable amount of gas storage for even a colder than average winter.

Because there was not a larger bearish response to this news, nor to news of cooler temperatures across the southern tier of the US, or the fact that gas production has reached all-time highs in recent weeks, or the potential for a warmer first half of the looming winter season; it suggests that gas market bulls aren’t ready to throw in the towel yet.

After tumbling down to the $5.40s/MMBtu area in the wake Freeport LNG terminal fire in early June, prices have nearly doubled from these lows in less than 2 months to yesterday’s high of $10.028/MMBtu.

Gas bulls are still pointing to the storage deficit of around 300 Bcf versus the five-year average as the reason to underpin prices and overall momentum continues to be with the gas bulls despite all of the bearish drivers in the market. This suggests that there could still be more attempts of buyers to retest the $10.00/MMBtu area.

It should be noted that there is already some scraped gas production data showing that dry gas volumes are on the cusp of pressing up to slightly north of 99 Bcf/d, which may be revealed much sooner than what the market realizes. Should this information verify soon, it will be interesting to see if gas bulls ignore this data as well.

Source: Gelber & Associates