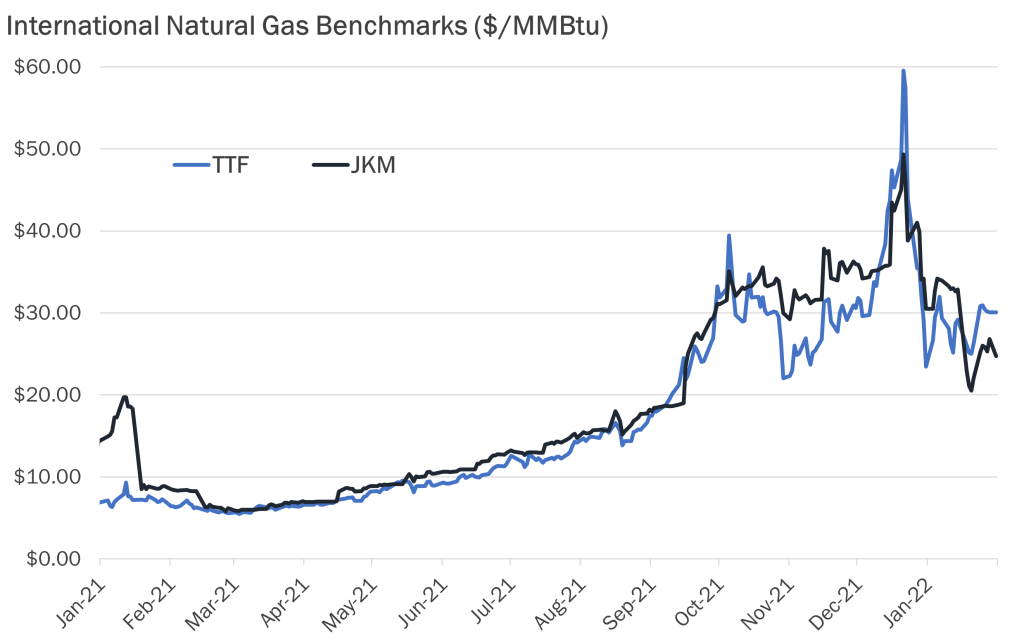

Since the runup to $60 gas prices in mid-December, international benchmarks have steadily fallen, with the European TTF having spent the last month in a consolidation range between $26 and $30.

Reports indicate that European benchmarks fell as high as ~10% today as a result of resumed Russian flows through Ukraine to Slovakia using the Velke Kapusany point.

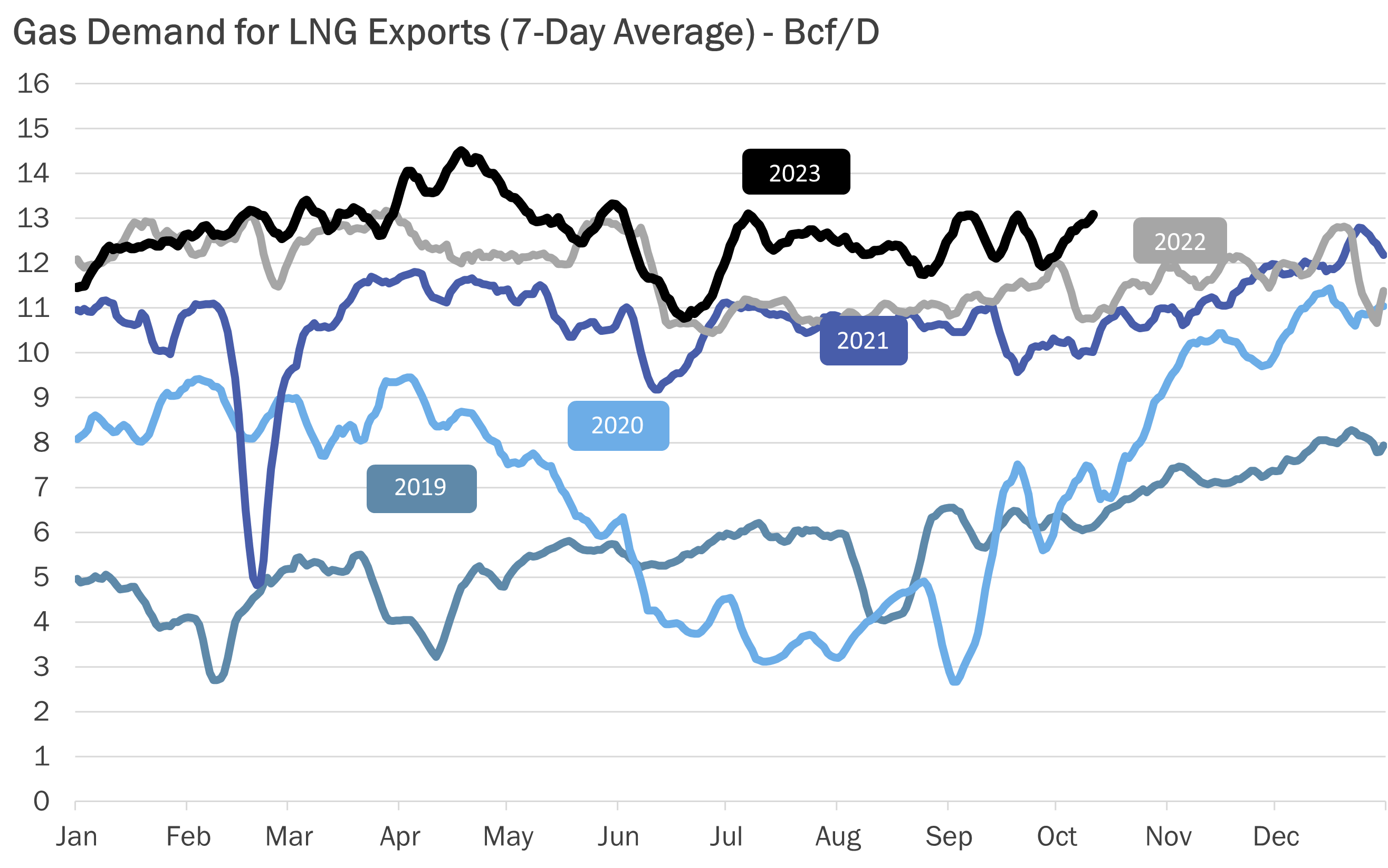

Mild European weather conditions have also decreased the immediate need for gas and an influx of LNG from international sources has thus far managed to serve as an alternative to stymied Russian pipeline flows to Europe.

Despite the effect of these calming forces on a relatively turbulent European market, the European TTF is still trading at a premium to the Asian JKM, and is likely to continue to do so in the near term.

The resumption of some degree of Russian flows through Ukraine may point to some sort of de-escalation of the tensions between Russia and Ukraine – however, it is too early to presume so. Even without the threat of invasion, the risk for cooler temperatures is still present in European markets, and would constitute more than enough upward price pressure by itself.

The topic of European Prices and its causes is a fascinating one, and the story of this energy crisis is not yet over.

source: Gelber and Associates